Question: bonds- Q20 (answer = three decimal) (1 pt) A share of preferred stock pays dividends at a predetermined rate, and so can be thought of

bonds- Q20 (answer = three decimal)

bonds- Q20 (answer = three decimal)

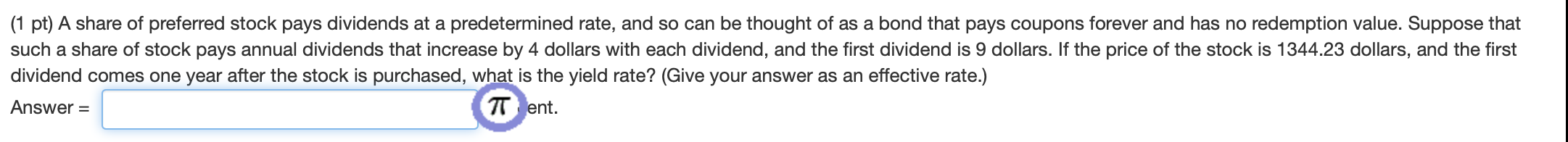

(1 pt) A share of preferred stock pays dividends at a predetermined rate, and so can be thought of as a bond that pays coupons forever and has no redemption value. Suppose that such a share of stock pays annual dividends that increase by 4 dollars with each dividend, and the first dividend is 9 dollars. If the price of the stock is 1344.23 dollars, and the first dividend comes one year after the stock is purchased, what is the yield rate? (Give your answer as an effective rate.) Answer = Tent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts