Question: Bones Noise Cancellation Technologies has five independent projects under consideration each with a required rate of return of 10%. The total projects budget is $6300

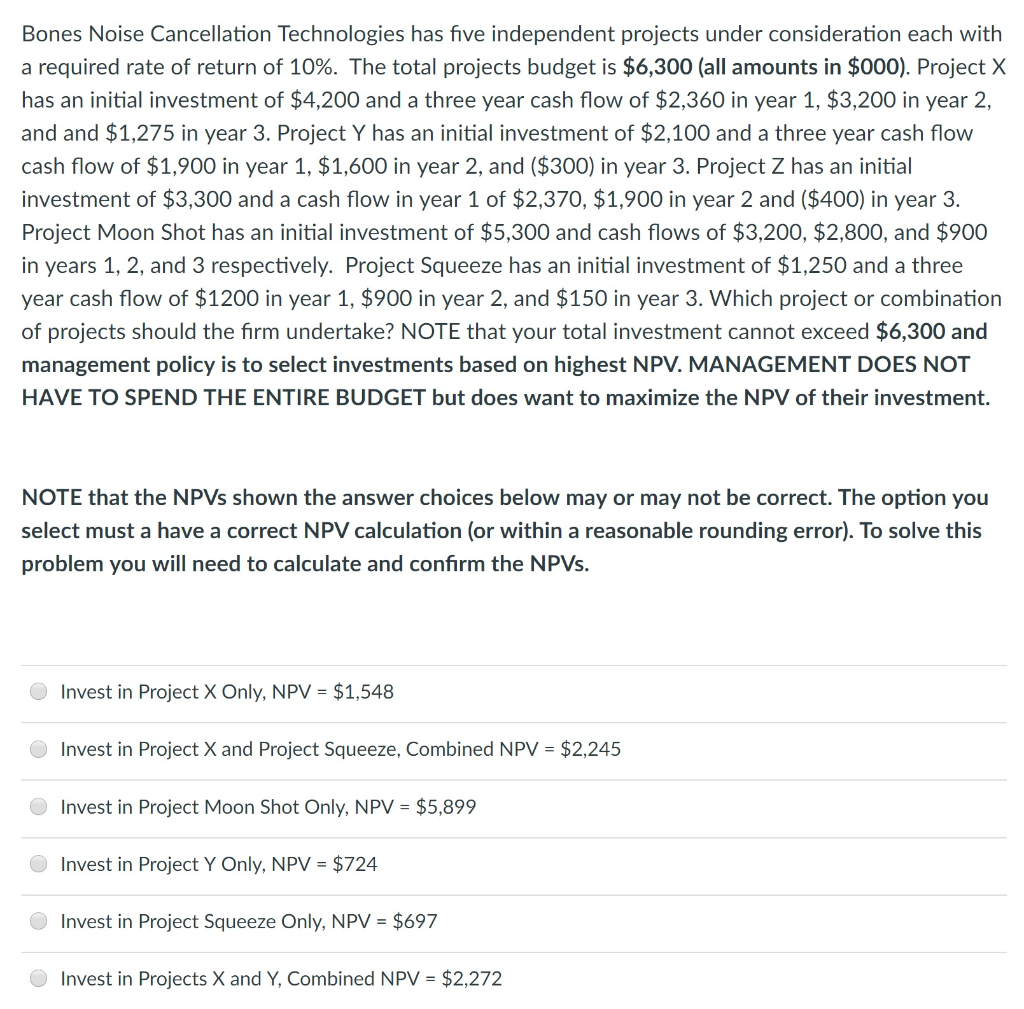

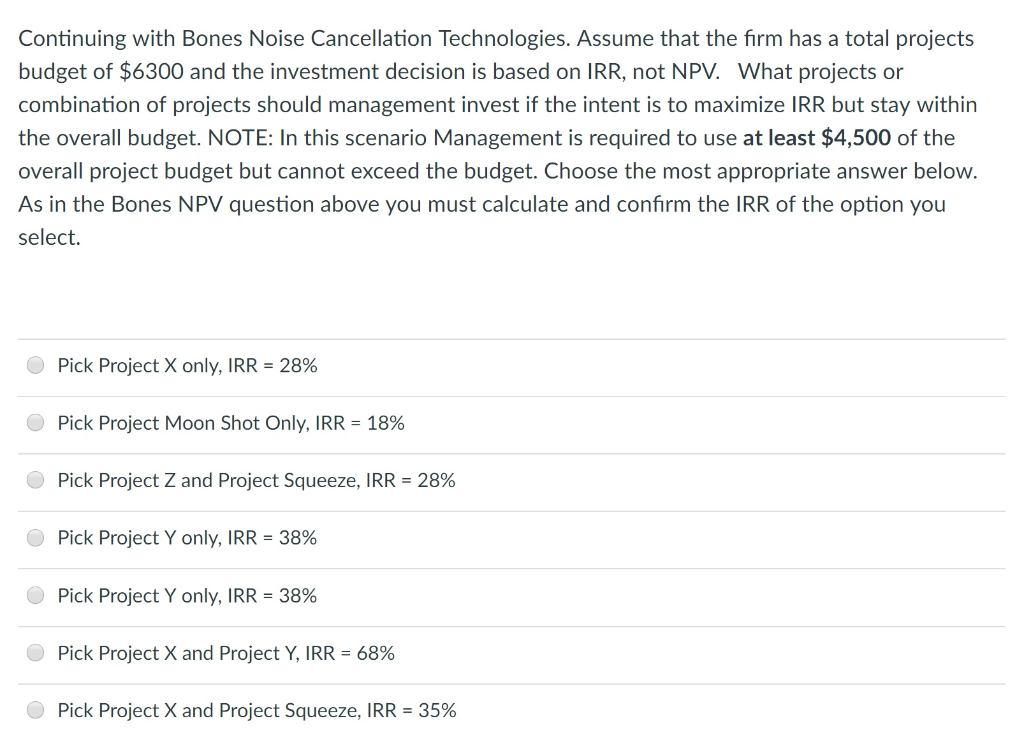

Bones Noise Cancellation Technologies has five independent projects under consideration each with a required rate of return of 10%. The total projects budget is $6300 (all amounts in $000). ProjectX has an initial investment of $4,200 and a three year cash flow of $2,360 in year 1, $3,200 in year 2, and and $1,275 in year 3. Project Y has an initial investment of $2,100 and a three year cash flow cash flow of $1,900 in year 1, $1,600 in year 2, and ($300) in year 3. Project Z has an initial investment of $3,300 and a cash flow in year 1 of $2,370, $1,900 in year 2 and ($400) in year 3. Project Moon Shot has an initial investment of $5,300 and cash flows of $3,200, $2,800, and $900 in years 1, 2, and 3 respectively. Project Squeeze has an initial investment of $1,250 and a three year cash flow of $1200 in year 1, $900 in year 2, and $150 in year 3. Which project or combination of projects should the firm undertake? NOTE that your total investment cannot exceed $6,300 and management policy is to select investments based on highest NPV. MANAGEMENT DOES NOT HAVE TO SPEND THE ENTIRE BUDGET but does want to maximize the NPV of their investment. NOTE that the NPVs shown the answer choices below may or may not be correct. The option you select must a have a correct NPV calculation (or within a reasonable rounding error). To solve this problem you will need to calculate and confirm the NPVs. Invest in Project X Only, NPV $1,548 Invest in Project X and Project Squeeze, combined NPV = $2,245 Invest in Project Moon Shot Only, NPV $5,899 Invest in Project Y Only, NPV = $724 Invest in Project Squeeze Only, NPV - $697 Invest in Projects X and Y, Combined NPV = $2.272 Continuing with Bones Noise Cancellation Technologies. Assume that the firm has a total projects budget of $6300 and the investment decision is based on IRR, not NPV. What projects or combination of projects should management invest if the intent is to maximize IRR but stay within the overall budget. NOTE: In this scenario Management is required to use at least $4,500 of the overall project budget but cannot exceed the budget. Choose the most appropriate answer below. As in the Bones NPV question above you must calculate and confirm the IRR of the option you select. Pick Project X only, IRR-28% O Pick Project Moon Shot Only, IRR-18% Pick Project Z and Project Squeeze, IRR = 28% Pick Project Y only, IRR-38% Pick Project Y only, IRR = 38% Pick Project X and Project Y, IRR = 68% Pick Project X and Project Squeeze, IRR-35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts