Question: Bonus Assessment AC 2034.docx Ans: S Open with Google Docs 3- Collins and Farina are forming a partnership. Collins is investing a building that has

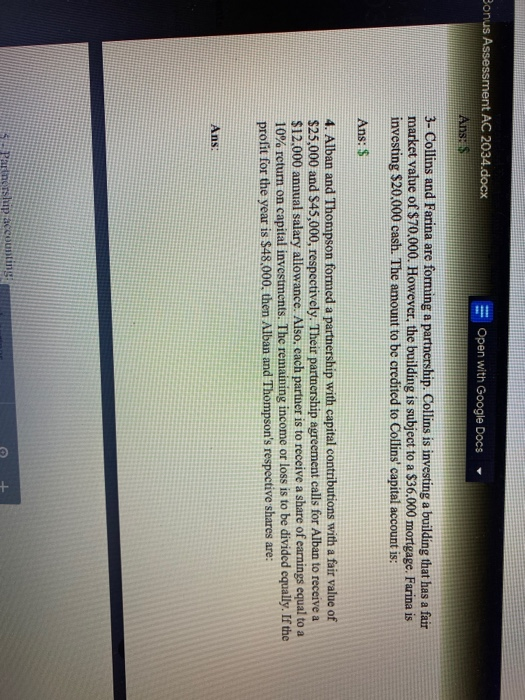

Bonus Assessment AC 2034.docx Ans: S Open with Google Docs 3- Collins and Farina are forming a partnership. Collins is investing a building that has a fair market value of $70,000. However, the building is subject to a $36.000 mortgage. Farina is investing $20,000 cash. The amount to be credited to Collins' capital account is: Ans: $ 4. Alban and Thompson formed a partnership with capital contributions with a fair value of $25,000 and $45,000, respectively. Their partnership agreement calls for Alban to receive a $12.000 annual salary allowance. Also, cach partner is to receive a share of earnings equal to a 10% return on capital investments. The remaining income or loss is to be divided equally. If the profit for the year is $48,000, then Alban and Thompson's respective shares are: Ans: Tshpace +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts