Question: Bonus Problem 1 (Optional, 20 marks) We consider a nT-year coupon bond which pays coupons every T years. The bond has face value F and

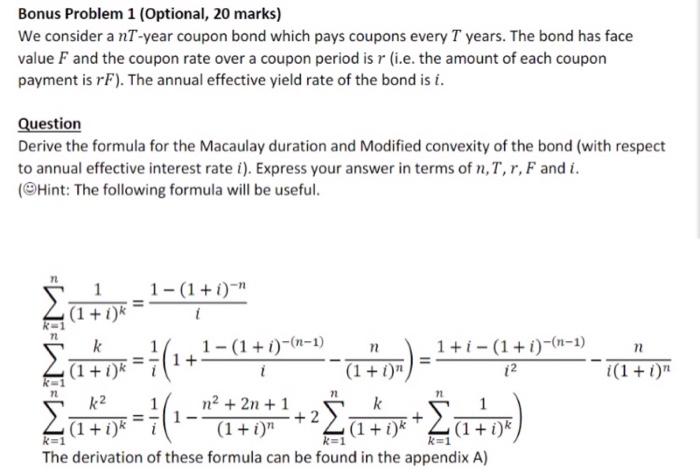

Bonus Problem 1 (Optional, 20 marks) We consider a nT-year coupon bond which pays coupons every T years. The bond has face value F and the coupon rate over a coupon period is r (i.e. the amount of each coupon payment is rF'). The annual effective yield rate of the bond is i. Question Derive the formula for the Macaulay duration and Modified convexity of the bond (with respect to annual effective interest rate i). Express your answer in terms of n, T,r, F and i. (Hint: The following formula will be useful. = ku n = Il 1 1- (1 + i)-" (1+1)* k 1-(1 + i)-(n-1) n 1 + i - (1 + i)-(n-1) (1+1)* 1 (1 + i)" 12 n2 + 2n + 1 k (1 + i)* (1 + i)" (1 + i)* (1 + i)* k=1 The derivation of these formula can be found in the appendix A) i(1 + i)" ==(1+1-01 ==(1-4. n k2 11 + 2 Zatok +30+7) + k=1 k=1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts