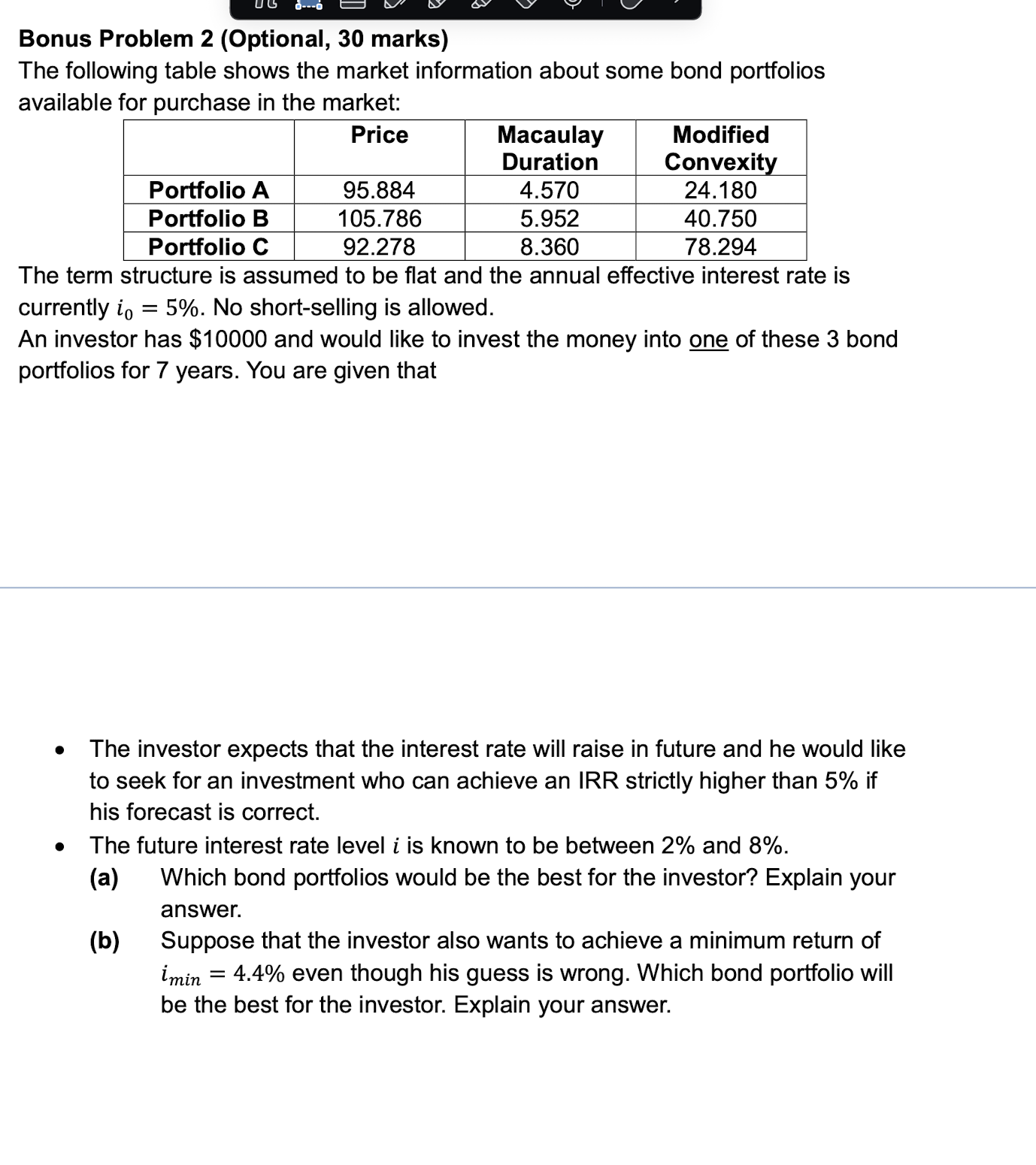

Question: Bonus Problem 2 ( Optional , 3 0 marks ) The following table shows the market information about some bond portfolios available for purchase in

Bonus Problem Optional marks The following table shows the market information about some bond portfolios available for purchase in the market: The term structure is assumed to be flat and the annual effective interest rate is currently i No shortselling is allowed. An investor has $ and would like to invest the money into one of these bond portfolios for years. You are given that The investor expects that the interest rate will raise in future and he would like to seek for an investment who can achieve an IRR strictly higher than if his forecast is correct. The future interest rate level i is known to be between and a Which bond portfolios would be the best for the investor? Explain your answer. b Suppose that the investor also wants to achieve a minimum return of imin even though his guess is wrong. Which bond portfolio will be the best for the investor. Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock