Question: BONUS QUESTION 10 James & Beth are a married couple in their early 50's. They have two children aged 23 and 25 who are both

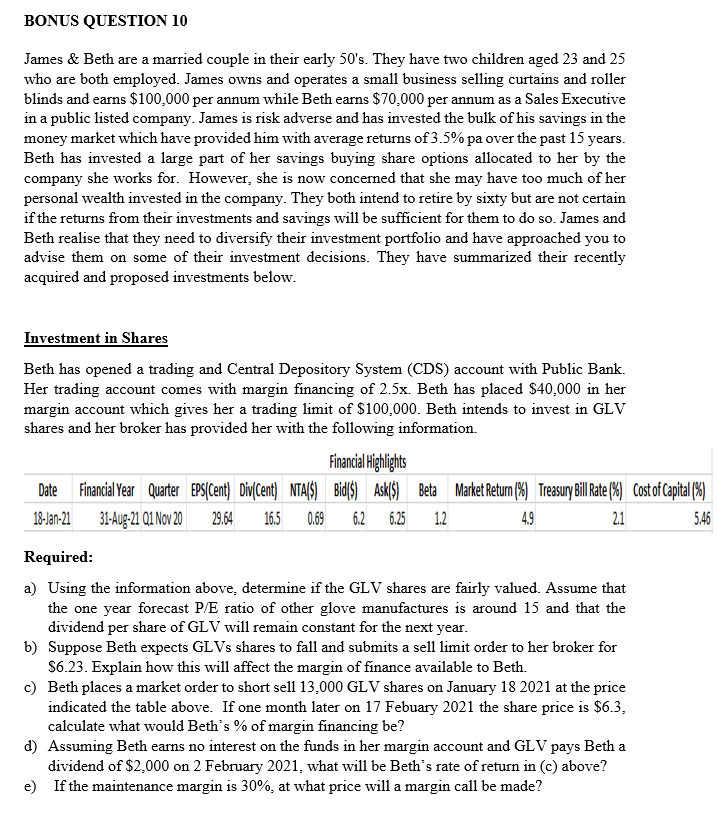

BONUS QUESTION 10 James & Beth are a married couple in their early 50's. They have two children aged 23 and 25 who are both employed. James owns and operates a small business selling curtains and roller blinds and earns $100,000 per annum while Beth earns $70,000 per annum as a Sales Executive in a public listed company. James is risk adverse and has invested the bulk of his savings in the money market which have provided him with average returns of 3.5% pa over the past 15 years. Beth has invested a large part of her savings buying share options allocated to her by the company she works for. However, she is now concerned that she may have too much of her personal wealth invested in the company. They both intend to retire by sixty but are not certain if the returns from their investments and savings will be sufficient for them to do so. James and Beth realise that they need to diversify their investment portfolio and have approached you to advise them on some of their investment decisions. They have summarized their recently acquired and proposed investments below. Investment in Shares Beth has opened a trading and Central Depository System (CDS) account with Public Bank. Her trading account comes with margin financing of 2.5x. Beth has placed $40,000 in her margin account which gives her a trading limit of $100,000. Beth intends to invest in GLV shares and her broker has provided her with the following information. Financial Highlights Date Financial Year Quarter EPS(Cent) Div(Cent) NTAIS) Bid($ ) Ask($) Beta Market Return (%) Treasury Bill Rate (%) Cost of Capital (%) 18-Jan-21 31-Aug-21 01 Nov 20 29.64 16.5 0.69 6.2 6.25 1.2 4.9 2.1 5.46 Required: a) Using the information above, determine if the GLV shares are fairly valued. Assume that the one year forecast P/E ratio of other glove manufactures is around 15 and that the dividend per share of GLV will remain constant for the next year. b) Suppose Beth expects GL Vs shares to fall and submits a sell limit order to her broker for $6.23. Explain how this will affect the margin of finance available to Beth. c) Beth places a market order to short sell 13.000 GLV shares on January 18 2021 at the price indicated the table above. If one month later on 17 Febuary 2021 the share price is $6.3, calculate what would Beth's % of margin financing be? d) Assuming Beth earns no interest on the funds in her margin account and GLV pays Beth a dividend of $2,000 on 2 February 2021, what will be Beth's rate of return in (c) above? e) If the maintenance margin is 30%, at what price will a margin call be made? BONUS QUESTION 10 James & Beth are a married couple in their early 50's. They have two children aged 23 and 25 who are both employed. James owns and operates a small business selling curtains and roller blinds and earns $100,000 per annum while Beth earns $70,000 per annum as a Sales Executive in a public listed company. James is risk adverse and has invested the bulk of his savings in the money market which have provided him with average returns of 3.5% pa over the past 15 years. Beth has invested a large part of her savings buying share options allocated to her by the company she works for. However, she is now concerned that she may have too much of her personal wealth invested in the company. They both intend to retire by sixty but are not certain if the returns from their investments and savings will be sufficient for them to do so. James and Beth realise that they need to diversify their investment portfolio and have approached you to advise them on some of their investment decisions. They have summarized their recently acquired and proposed investments below. Investment in Shares Beth has opened a trading and Central Depository System (CDS) account with Public Bank. Her trading account comes with margin financing of 2.5x. Beth has placed $40,000 in her margin account which gives her a trading limit of $100,000. Beth intends to invest in GLV shares and her broker has provided her with the following information. Financial Highlights Date Financial Year Quarter EPS(Cent) Div(Cent) NTAIS) Bid($ ) Ask($) Beta Market Return (%) Treasury Bill Rate (%) Cost of Capital (%) 18-Jan-21 31-Aug-21 01 Nov 20 29.64 16.5 0.69 6.2 6.25 1.2 4.9 2.1 5.46 Required: a) Using the information above, determine if the GLV shares are fairly valued. Assume that the one year forecast P/E ratio of other glove manufactures is around 15 and that the dividend per share of GLV will remain constant for the next year. b) Suppose Beth expects GL Vs shares to fall and submits a sell limit order to her broker for $6.23. Explain how this will affect the margin of finance available to Beth. c) Beth places a market order to short sell 13.000 GLV shares on January 18 2021 at the price indicated the table above. If one month later on 17 Febuary 2021 the share price is $6.3, calculate what would Beth's % of margin financing be? d) Assuming Beth earns no interest on the funds in her margin account and GLV pays Beth a dividend of $2,000 on 2 February 2021, what will be Beth's rate of return in (c) above? e) If the maintenance margin is 30%, at what price will a margin call be made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts