Question: Book & Accounting Bookstore has used an old coding machine for 3 years and desires to buy a new coding machine to help control book

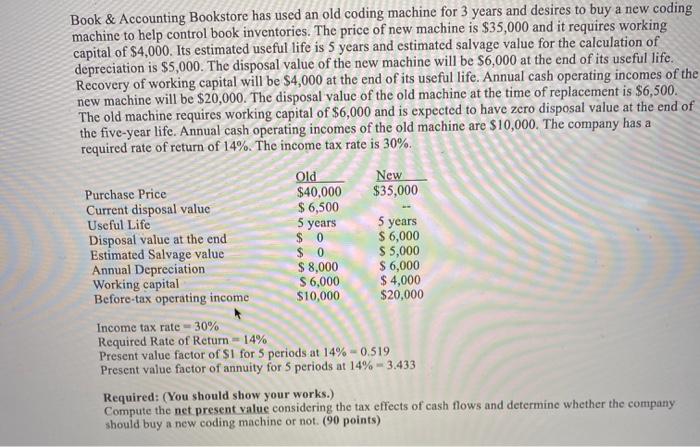

Book & Accounting Bookstore has used an old coding machine for 3 years and desires to buy a new coding machine to help control book inventories. The price of new machine is $35,000 and it requires working capital of $4,000. Its estimated useful life is 5 years and estimated salvage value for the calculation of depreciation is $5,000. The disposal value of the new machine will be $6,000 at the end of its useful life. Recovery of working capital will be $4,000 at the end of its useful life. Annual cash operating incomes of the new machine will be $20,000. The disposal value of the old machine at the time of replacement is $6,500. The old machine requires working capital of $6,000 and is expected to have zcro disposal value at the end of the five-year life. Annual cash operating incomes of the old machine are $10,000. The company has a required rate of return of 14%. The income tax rate is 30%. Old New Purchase Price $40,000 $35,000 Current disposal value $6,500 Useful Life 5 years 5 years Disposal value at the end $ 0 $ 6,000 Estimated Salvage value $ 0 $ 5,000 Annual Depreciation $ 8,000 $ 6,000 Working capital $ 6,000 $ 4,000 Before-tax operating income $10,000 $20,000 Income tax rate - 30% Required Rate of Return -14% Present value factor of Si for 5 periods at 14% -0.519 Present value factor of annuity for 5 periods at 14% - 3.433 Required: (You should show your works.) Compute the net present value considering the tax effects of cash flows and determine whether the company should buy a new coding machine or not. (90 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts