Question: Book Show Me How Cash Flows from Operating Activities -- Indirect Method The net income reported on the income statement for the current year was

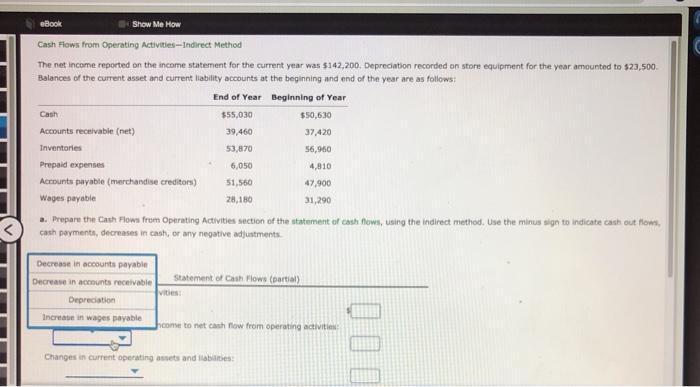

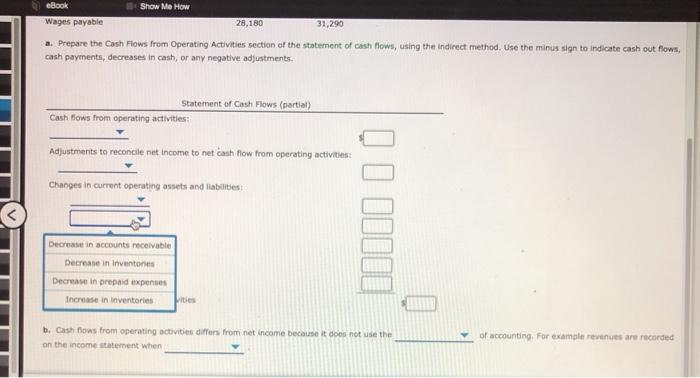

Book Show Me How Cash Flows from Operating Activities -- Indirect Method The net income reported on the income statement for the current year was $142,200. Depreciation recorded on store equipment for the year amounted to $23.500 Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $55,030 $50,630 Accounts receivable (net) 39,460 37,420 Inventories 53,870 56,960 Prepaid expenses 6,050 4,810 Accounts payable (merchandise creditor) 51,560 47,900 Wages payable 28,180 31,290 . Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the Indirect method. Use the minus sign to indicate cash out to cash payments, decreases in cash, or any negative adjustments Decrease in accounts payable Decrease in accounts receivable Statement of Cash Flowe (partial) vities: Depreciation Increase in wages payable home to net cash low from operating activiti Changes in current operating assets and tables eBook Show Me How Wages payable 28,180 31,290 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the Indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating ossets and liabilities Decrease in accounts receivable Decrease in inventores Decrease in prepaid expenses Increase in inventories b. Cash nows from operating activities differs from net income because it does not use the on the income statement when of accounting. For example revenues are recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts