Question: Book - Tax Difference Project o ABC uses MACRS ( an accelerated depreciation system ) for tax purposes and straight - line depreciation for book

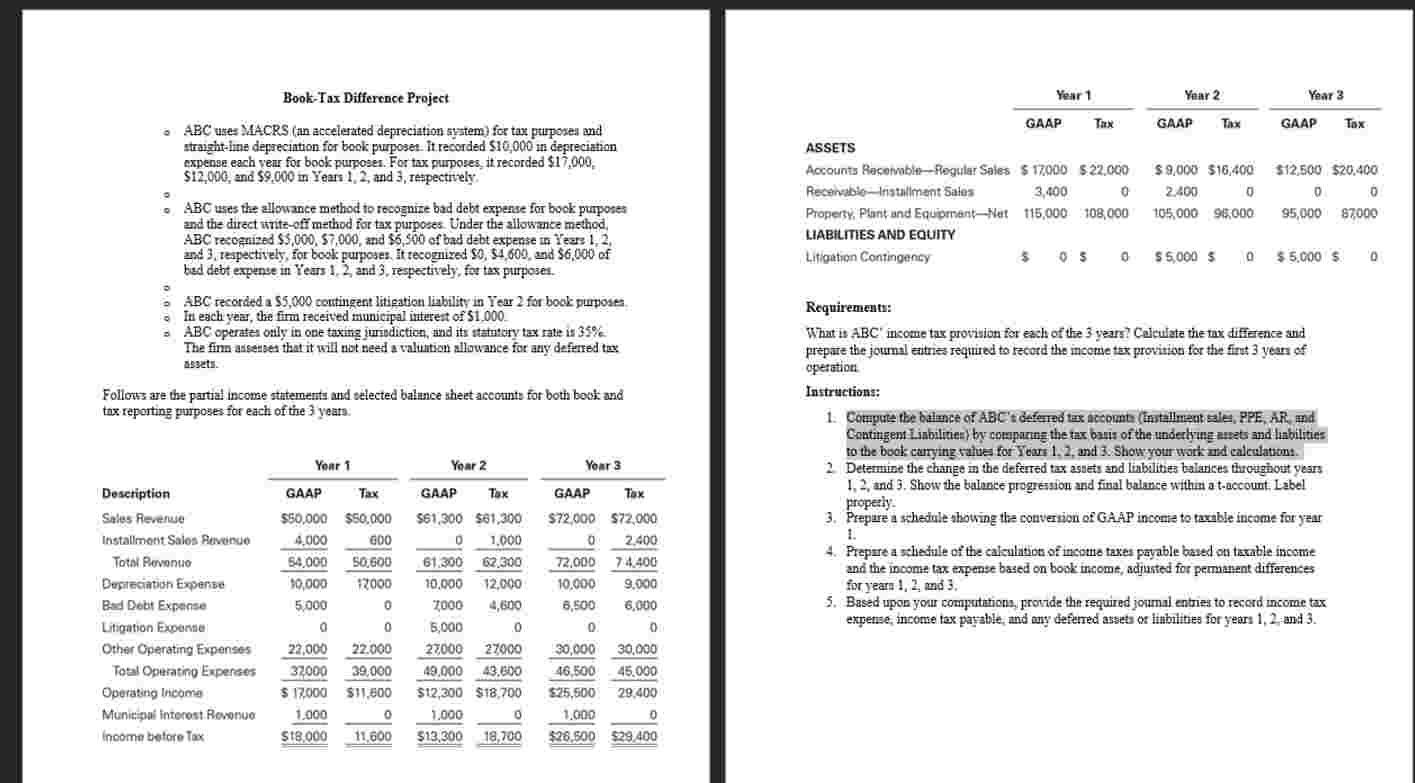

BookTax Difference Project o ABC uses MACRS an accelerated depreciation system for tax purposes and straightline depreciation for book purposes. It recorded $ in depreciation expense each year for book purposes. For tax purposes, it recorded $ $ and $ in Years and respectively. o o ABC uses the allowance method to recognize bad debt expense for book purposes and the direct writeoff method for tax purposes. Under the allowance method, ABC recognized $ $ and $ of bad debt expense in Years and respectively, for book purposes. It recognized $ $ and $ of bad debt expense in Years and respectively, for tax purposes. o o ABC recorded a $ contingent litigation liability in Year for book purposes. o In each year, the firm received municipal interest of $ o ABC operates only in one taxing jurisdiction, and its statutory tax rate is The firm assesses that it will not need a valuation allowance for any deferred tax assets. Follows are the partial income statements and selected balance sheet accounts for both book and tax reporting purposes for each of the years. Requirements: What is ABC income tax provision for each of the years? Calculate the tax difference and prepare the journal entries required to record the income tax provision for the first years of operation. Instructions: Compute the balance of ABCs deferred tax accounts Installment sales, PPE, AR and Contingent Liabilities by comparing the tax basis of the underlying assets and liabilities to the book carrying values for Years and Show your work and calculations. Determine the change in the deferred tax assets and liabilities balances throughout years and Show the balance progression and final balance within a taccount. Label properly. Prepare a schedule showing the conversion of GAAP income to taxable income for year Prepare a schedule of the calculation of income taxes payable based on taxable income and the income tax expense based on book income, adjusted for permanent differences for years and Based upon your computations, provide the required journal entries to record income tax expense, income tax payable, and any deferred assets or liabilities for years and

Installment Sale Revenue Tax Adjustment Project template Excel

oyuka adiya

File Home

Insert

Page Layout

Formulas

Data

Review

View

Help

Power Pivot

Tell me what you want to do

GET GENUINE OFFICE Your license isn't genuine, and you may be a victim of software counterfeiting. Avoid interruption and keep your files safe with genuine Office today.

Get genuine Office

Learn more

tax income tax rate

Compute the income taxes payable and income tax payable.

begintabularcccccc

hline & Year & Year & Year & &

hline Income Tax Payable & & & & tax income & x rate

hline add deferred liabilites & & & & &

hline less deferred assets & & & & &

hline & & & & &

hline Income Tax Expense & & & & &

hline

endtabular

Income Tax Expense

E

F

G

H

I

K

L

M

N

P

begintabularllll

hline & Year & Year & Year

hline

endtabular

Income Tax Payable

add deferred liabilites

less deferred assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock