Question: Book - Tax Difference Reporting on the Schedule M - 3 ( 3 0 pts ) The following is a typical template for book -

BookTax Difference Reporting on the Schedule M pts

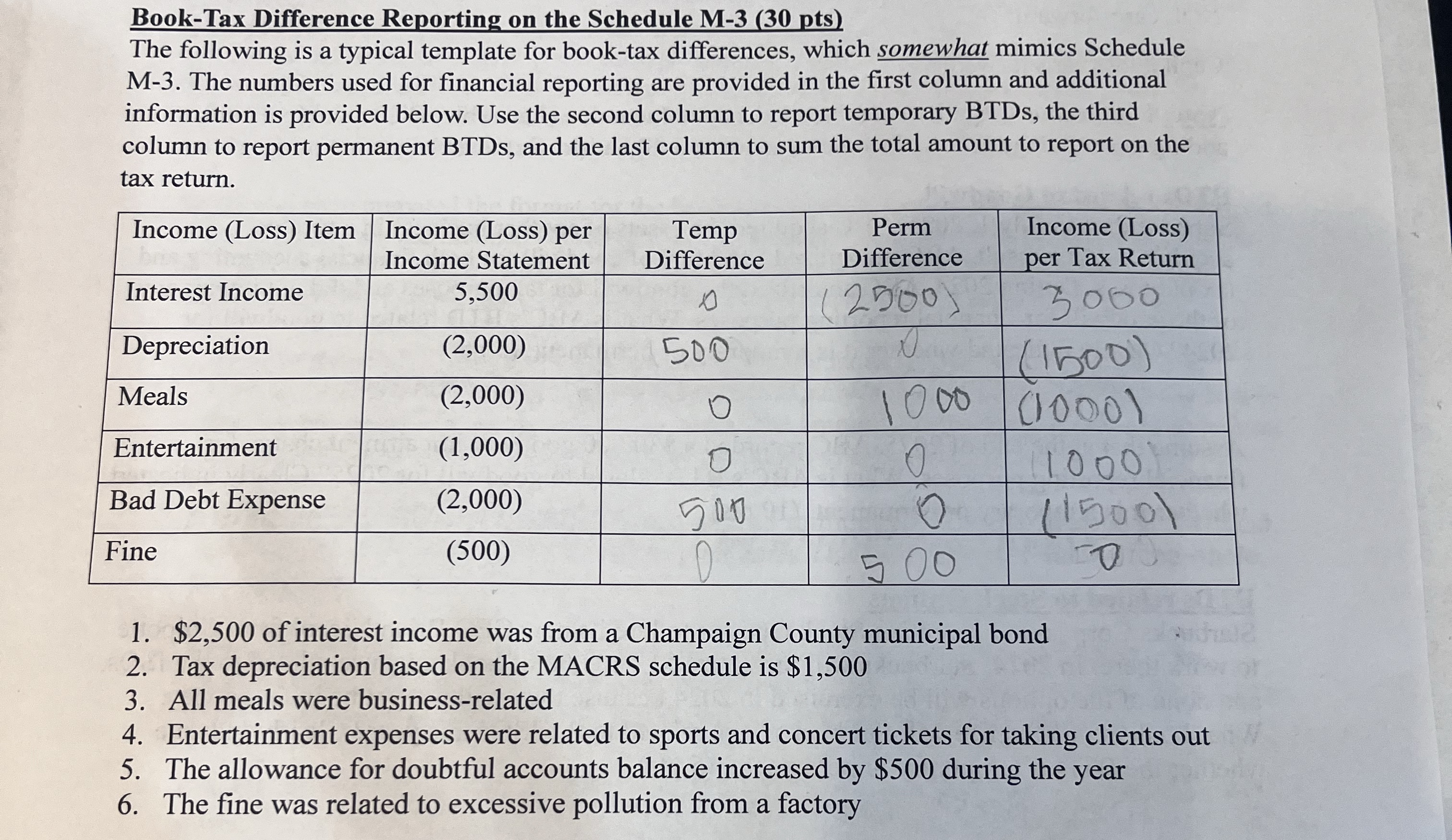

The following is a typical template for booktax differences, which somewhat mimics Schedule M The numbers used for financial reporting are provided in the first column and additional information is provided below. Use the second column to report temporary BTDs the third column to report permanent BTDs and the last column to sum the total amount to report on the tax return.

tableIncome Loss Item,tableIncome Loss perIncome StatementtableTempDifferencetablePermDifferencetableIncome Lossper Tax ReturnInterest Income,Depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock