Question: Bookmarks Window Help on.com 0 Connect MHE Reader k my work mode : This shows what is correct or incorrect for the work you have

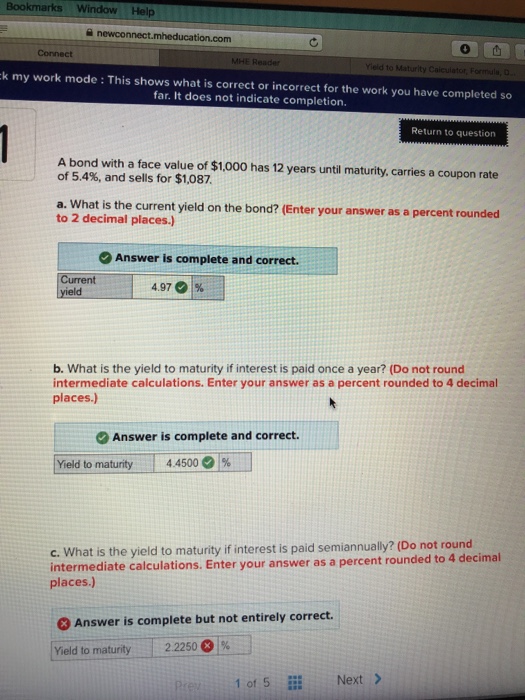

Bookmarks Window Help on.com 0 Connect MHE Reader k my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to question A bond with a face value of $1000 has 12 years until maturity, carries a coupon rate of 5.4%, and sells for $1,087. a. What is the current yield on the bond? (Enter your answer as a percent rounded to 2 decimal places. Answer is complete and correct. ent 4.97 )% b. What is the yield to maturity if interest is paid once a year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places.) Answer is complete and correct. Yield to maturity 144500 -% | c. What is the yield to maturity if interest is paid semiannually? (Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places.) & Answer is complete but not entirely correct. Yield to maturity | 2.2250% 1 of 5l Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts