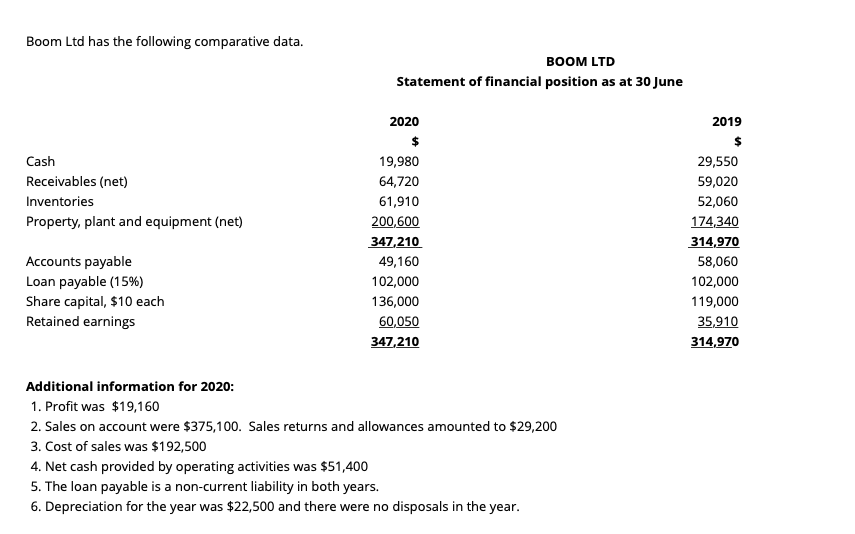

Question: Boom Ltd has the following comparative data. BOOM LTD Statement of financial position as at 30 June 2020 Cash Receivables (net) Inventories Property, plant and

Boom Ltd has the following comparative data. BOOM LTD Statement of financial position as at 30 June 2020 Cash Receivables (net) Inventories Property, plant and equipment (net) 19,980 64,720 61,910 200,600 347,210 49,160 102,000 136,000 60,050 347,210 2019 $ 29,550 59,020 52,060 174,340 314,970 58,060 102,000 119,000 35,910 314,970 Accounts payable Loan payable (15%) Share capital, $10 each Retained earnings Additional information for 2020: 1. Profit was $19,160 2. Sales on account were $375,100. Sales returns and allowances amounted to $29,200 3. Cost of sales was $192,500 4. Net cash provided by operating activities was $51,400 5. The loan payable is a non-current liability in both years. 6. Depreciation for the year was $22,500 and there were no disposals in the year. Required Calculate the following at 30 June 2020 (round your final answers to 2 decimal places): a) Current ratio. b) Quick ratio. c) Average collection period. d) Average days in inventory. e) Cash return on sales ratio. f) Cash debt coverage. g) Current cash debt coverage. h) Capital expenditure ratio i) Free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts