Question: booster banks case Analyze this case using a strategic perspective. In your answer cover the following: a. Look at this case from the standpoint of

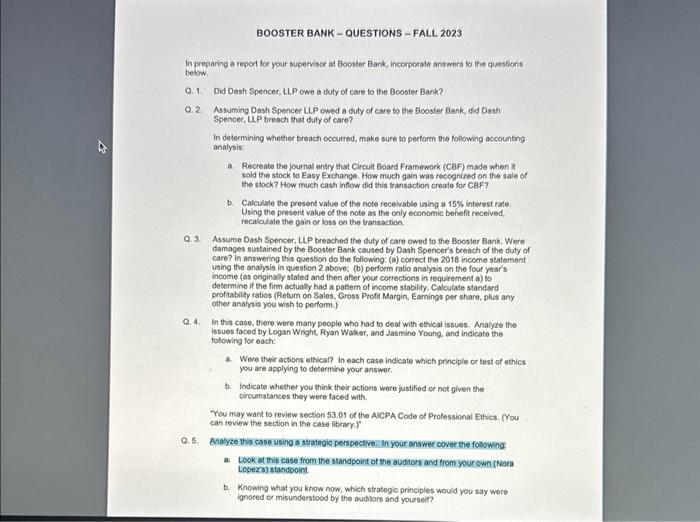

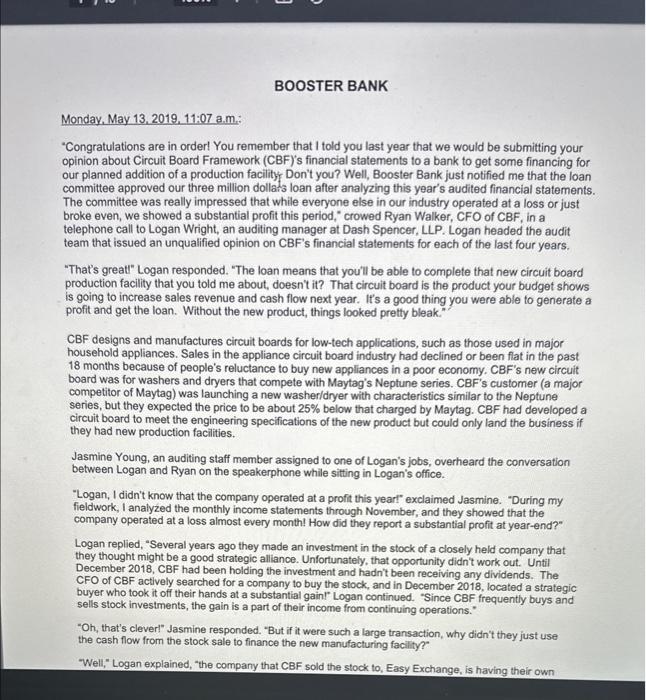

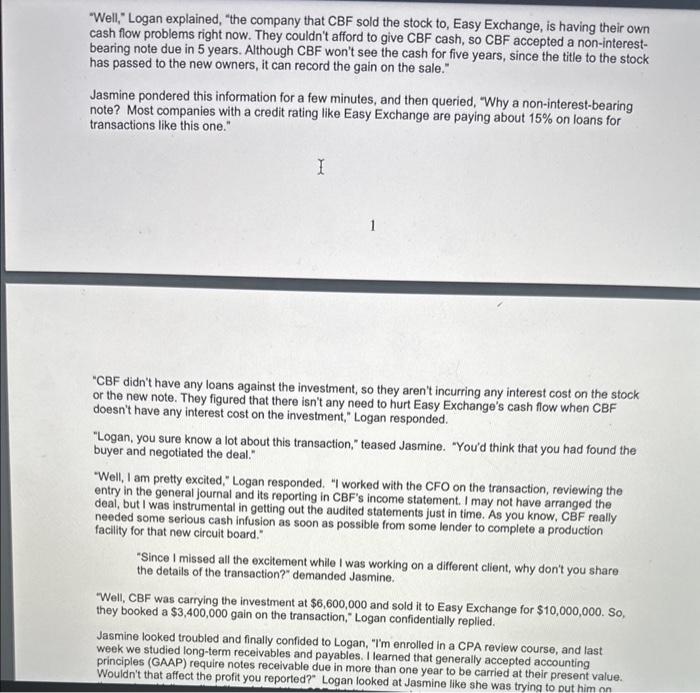

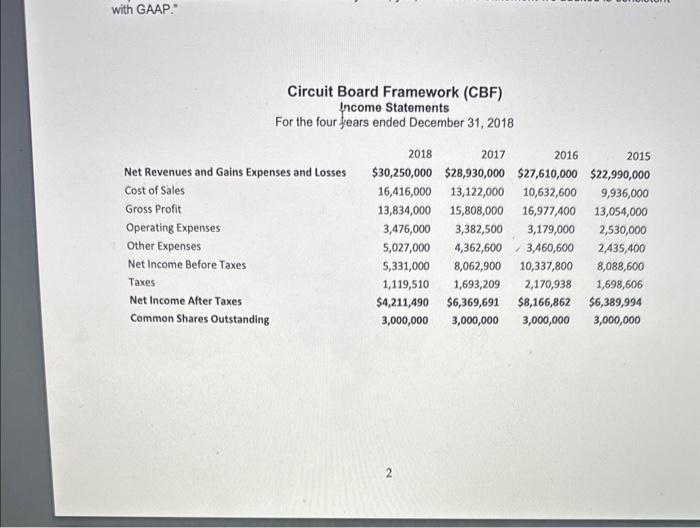

"Well," Logan explained, "the company that CBF sold the stock to, Easy Exchange, is having their own cash flow problems right now. They couldn't afford to give CBF cash, so CBF accepted a non-interestbearing note due in 5 years. Although CBF won't see the cash for five years, since the title to the stock has passed to the new owners, it can record the gain on the sale." Jasmine pondered this information for a few minutes, and then queried, "Why a non-interest-bearing note? Most companies with a credit rating like Easy Exchange are paying about 15% on loans for transactions like this one." 1 "CBF didn't have any loans against the investment, so they aren't incurring any interest cost on the stock or the new note. They figured that there isn't any need to hurt Easy Exchange's cash flow when CBF doesn't have any interest cost on the investment," Logan responded. "Logan, you sure know a lot about this transaction," teased Jasmine. "You'd think that you had found the buyer and negotiated the deal." "Well, I am pretty excited," Logan responded. "I worked with the CFO on the transaction, reviewing the entry in the general journal and its reporting in CBF's income statement. I may not have arranged the deal, but I was instrumental in getting out the audited statements just in time. As you know, CBF really needed some serious cash infusion as soon as possible from some lender to complete a production facility for that new circuit board." "Since I missed all the excitement while I was working on a different client, why don't you share the details of the transaction?" demanded Jasmine. Well, CBF was carrying the investment at $6,600,000 and sold it to Easy Exchange for $10,000,000. So, they booked a $3,400,000 gain on the transaction," Logan confidentially replied. Jasmine looked troubled and finally confided to Logan, "I'm enrolled in a CPA review course, and last week we studied long-term receivables and payables. I learned that generally accepted accounting principles (GAAP) require notes receivable due in more than one year to be carried at their present value. Wouldn't that affect the profit you reported? Logan looked at Jasmine like she was tring the velue. Circuit Board Framework (CBF) Income Statements For the four fyears ended December 31,2018 To: Nora Lopez, Loan Delinquency Department, Booster Bank. From: Juan Parker, Senior Lending Officer, Booster Bank Date: January 17,2022 Re: Default on CBF's loan As I mentioned to you earlier today, I am forwarding to you the CBF's file. It is now in default on the three million dollar loan we extended on May 10, 2019. The total amount currently outstanding is $2,390,000. We were just informed yesterday that CBF has commenced bankruptcy protection under Chapter 7 of the Bankruptcy Code. As such, the prospects of a full recovery are minimal. In addition to the loan documents, I am attaching copies of all the financial statements that we obtained from CBF as part of the loan application, including the one for the year 2018, which we received from CBF's CFO on March 2, 2019. In looking back at the financial statements that we had in our file, I was stunned by CBF's dramatic and sudden collapse. When we approved the loan, the loan committee gave a lot of weight not only to the financial statements from 2018 but also to the ones from the prior three years; we were keenly impressed by the firm's pattern of income stability during those four calendar years. I am also attaching a copy of an article I had placed in my file a number of years back. Ever since reading the article, I have had a lingering suspicion that the story in the article is about CBF. GREEN TIMES December 13, 2019 Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities boards, had substantially overstated income and assets in contravention with General Accepted Accounting Principles. It is really too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain To: Nora Lopez, Loan Delinquency Department, Booster Bank. From: Juan Parker, Senior Lending Officer, Booster Bank Date: January 17,2022 Re: Default on CBF's loan As I mentioned to you earlier today, I am forwarding to you the CBF's file. It is now in default on the three million dollar loan we extended on May 10, 2019. The total amount currently outstanding is $2,390,000. We were just informed yesterday that CBF has commenced bankruptcy protection under Chapter 7 of the Bankruptcy Code. As such, the prospects of a full recovery are minimal. In addition to the loan documents, I am attaching copies of all the financial statements that we obtained from CBF as part of the loan application, including the one for the year 2018, which we received from CBF's CFO on March 2, 2019. In looking back at the financial statements that we had in our file, I was stunned by CBF's dramatic and sudden collapse. When we approved the loan, the loan committee gave a lot of weight not only to the financial statements from 2018 but also to the ones from the prior three years; we were keenly impressed by the firm's pattern of income stability during those four calendar years. I am also attaching a copy of an article I had placed in my file a number of years back. Ever since reading the article, I have had a lingering suspicion that the story in the article is about CBF. GREEN TIMES December 13, 2019 Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities boards, had substantially overstated income and assets in contravention with General Accepted Accounting Principles. It is really too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities practiced by senior partners at Dash Spencer, LLP. "I have been really disillusioned with the level of scrutiny the senior managers and partners have been employing with regard to a number of audit engagements. In one case that I have worked on while I was an intern, my former manager signed off on an unqualified audit opinion where the client, a designer and manufacturer of home appliance circuit Accepted Accounting Principles. It is re too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain 3 Required: Assume that you are Ms. Lopez, an associate in the Loan Delinquency Department at the Booster Bank. Your supervisor would like to find out from you whether Booster Bank has a claim of negligence against the accounting firm of Dash Spencer, LLP. You have gathered additional information from the bankruptcy courts and know about the 2018 sale of stock to Easy Exchange and its accounting treatment in the income statement. Read the legal cases collected by the legal assistant and attached in the Library. Assume that the applicable precedent is from the fictional jurisdiction of the state of Green provided to you in the attached library. Assume that the financial statements audited by Dash Spencer for the calendar years of 2017, 2016, and 2015 were accurate. Prepare a report (see guidelines on the class website) for your supervisor. In preparing a report for your supervisor at Booster Bank, incorporate answers fo the questions below. Q.1. Did Dash Spencer, LLP owe a duty of care to the Bcoster Bank? Q.2 Assuming Dash Spencer LLP ewed a duty of care to the Booster Bank, dd Oash Spencer, U.P breach that duty of care? In determining whether breach occurred, make sure to perform the following accounting analysis: a. Recreate the journal entry that Circult Board Framework (CBF) made when it sold the stock to Easy Exchange. How much gain was recognized on the sale of the slock? How much cash inflow did this transaction croale for CEF? b. Calculate the present value of the note receivable using a 15% interest rate. Using the present value of the note as the coly economic benefit received, recalculate the gain or loss on the transaction. Q.3. Assume Dash Spencer. LLP breached the duty of care owed to the Booster Bank. Were damages sustained by the Booster Bank caused by Dash Spencer's breach of the duty of care? In answering this question do the following: (a) correct the 2018 income statemant using the analysis in question 2 above: (b) perform ratio analysis on the four year's income (as originalis stated and then after your corrections in requirement a) io determine if the firm actually had a patiem of income stability. Caloulate standard profitability ratios (Reburn on Sales, Gross Profit Margin, Earnings per share, plus any other analysis you wish to perform.) Q.4. In this case, there were many people who had to deal with ethical issues. Analyze the issues faced by Logan Wright, Ryan Waker, and Jasmine Young, and indicate the following for each: a. Were their actions ethicar? in each case indicate which principle or test of echics. you are applying to determine your answer. b. Indicate whether you think their actions were justified or not given the circumstances they were faced with. You may want to review section 53.01 of the AICPA Code of Prolessional Ethics. (You can review the section in the case library. Q.5. Analze this case using a strategio perspectve. In your answer cover the following a. Look at this case from the standpoint of the auditors and from your own (Nora Lopez's) standpoint. b. Knowing what you know now, which strategic prineiples would you say were ignored or misunderstoed by the auditors and yoursel? Monday, May 13, 2019, 11:07 a.m.: "Congratulations are in order! You remember that I told you last year that we would be submitting your opinion about Circuit Board Framework (CBF)'s financial statements to a bank to get some financing for our planned addition of a production facility, Don't you? Well, Booster Bank just notified me that the loan committee approved our three million dollats loan after analyzing this year's audited financial statements. The committee was really impressed that while everyone else in our industry operated at a loss or just broke even, we showed a substantial profit this period," crowed Ryan Walker, CFO of CBF, in a telephone call to Logan Wright, an auditing manager at Dash Spencer, LLP. Logan headed the audit team that issued an unqualified opinion on CBF's financial statements for each of the last four years. "That's great" Logan responded. "The loan means that you'll be able to complete that new circuit board production facility that you told me about, doesn't it? That circuit board is the product your budget shows is going to increase sales revenue and cash flow next year. It's a good thing you were able to generate a profit and get the loan. Without the new product, things looked pretty bleak." CBF designs and manufactures circuit boards for low-tech applications, such as those used in major household appliances. Sales in the appliance circuit board industry had declined or been flat in the past 18 months because of people's reluctance to buy new appliances in a poor economy. CBF's new circuit board was for washers and dryers that compete with Maytag's Neptune series. CBF's customer (a major competitor of Maytag) was launching a new washer/dryer with characteristics similar to the Neptune series, but they expected the price to be about 25% below that charged by Maytag. CBF had developed a circuit board to meet the engineering specifications of the new product but could only land the business if they had new production facilities. Jasmine Young, an auditing staff member assigned to one of Logan's jobs, overheard the conversation between Logan and Ryan on the speakerphone while sitting in Logan's office. "Logan, I didn't know that the company operated at a profit this yearl" exclaimed Jasmine. "During my fieldwork, I analyzed the monthly income statements through November, and they showed that the company operated at a loss almost every month! How did they report a substantial profit at year-end?" Logan replied, "Several years ago they made an investment in the stock of a closely held company that they thought might be a good strategic alliance. Unfortunately, that opportunity didn't work out. Until December 2018, CBF had been holding the investment and hadn't been receiving any dividends. The CFO of CBF actively searched for a company to buy the stock, and in December 2018, located a strategic buyer who took it off their hands at a substantial gainr" Logan continued. "Since CBF frequently buys and sells stock investments, the gain is a part of their income from continuing operations." "Oh, that's cleverl" Jasmine responded. "But if it were such a large transaction, why didn't they just use the cash flow from the stock sale to finance the new manufacturing facility? "Well," Logan explained, "the company that CBF sold the stock to, Easy Exchange, is having their own cash flow problems right now. They couldn't afford to give CBF cash, so CBF accepted a non-interestbearing note due in 5 years. Although CBF won't see the cash for five years, since the title to the stock has passed to the new owners, it can record the gain on the sale." Jasmine pondered this information for a few minutes, and then queried, "Why a non-interest-bearing note? Most companies with a credit rating like Easy Exchange are paying about 15% on loans for transactions like this one." 1 "CBF didn't have any loans against the investment, so they aren't incurring any interest cost on the stock or the new note. They figured that there isn't any need to hurt Easy Exchange's cash flow when CBF doesn't have any interest cost on the investment," Logan responded. "Logan, you sure know a lot about this transaction," teased Jasmine. "You'd think that you had found the buyer and negotiated the deal." "Well, I am pretty excited," Logan responded. "I worked with the CFO on the transaction, reviewing the entry in the general journal and its reporting in CBF's income statement. I may not have arranged the deal, but I was instrumental in getting out the audited statements just in time. As you know, CBF really needed some serious cash infusion as soon as possible from some lender to complete a production facility for that new circuit board." "Since I missed all the excitement while I was working on a different client, why don't you share the details of the transaction?" demanded Jasmine. Well, CBF was carrying the investment at $6,600,000 and sold it to Easy Exchange for $10,000,000. So, they booked a $3,400,000 gain on the transaction," Logan confidentially replied. Jasmine looked troubled and finally confided to Logan, "I'm enrolled in a CPA review course, and last week we studied long-term receivables and payables. I learned that generally accepted accounting principles (GAAP) require notes receivable due in more than one year to be carried at their present value. Wouldn't that affect the profit you reported? Logan looked at Jasmine like she was tring the velue. Circuit Board Framework (CBF) Income Statements For the four fyears ended December 31,2018 To: Nora Lopez, Loan Delinquency Department, Booster Bank. From: Juan Parker, Senior Lending Officer, Booster Bank Date: January 17,2022 Re: Default on CBF's loan As I mentioned to you earlier today, I am forwarding to you the CBF's file. It is now in default on the three million dollar loan we extended on May 10, 2019. The total amount currently outstanding is $2,390,000. We were just informed yesterday that CBF has commenced bankruptcy protection under Chapter 7 of the Bankruptcy Code. As such, the prospects of a full recovery are minimal. In addition to the loan documents, I am attaching copies of all the financial statements that we obtained from CBF as part of the loan application, including the one for the year 2018, which we received from CBF's CFO on March 2, 2019. In looking back at the financial statements that we had in our file, I was stunned by CBF's dramatic and sudden collapse. When we approved the loan, the loan committee gave a lot of weight not only to the financial statements from 2018 but also to the ones from the prior three years; we were keenly impressed by the firm's pattern of income stability during those four calendar years. I am also attaching a copy of an article I had placed in my file a number of years back. Ever since reading the article, I have had a lingering suspicion that the story in the article is about CBF. GREEN TIMES December 13, 2019 Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities boards, had substantially overstated income and assets in contravention with General Accepted Accounting Principles. It is really too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain To: Nora Lopez, Loan Delinquency Department, Booster Bank. From: Juan Parker, Senior Lending Officer, Booster Bank Date: January 17,2022 Re: Default on CBF's loan As I mentioned to you earlier today, I am forwarding to you the CBF's file. It is now in default on the three million dollar loan we extended on May 10, 2019. The total amount currently outstanding is $2,390,000. We were just informed yesterday that CBF has commenced bankruptcy protection under Chapter 7 of the Bankruptcy Code. As such, the prospects of a full recovery are minimal. In addition to the loan documents, I am attaching copies of all the financial statements that we obtained from CBF as part of the loan application, including the one for the year 2018, which we received from CBF's CFO on March 2, 2019. In looking back at the financial statements that we had in our file, I was stunned by CBF's dramatic and sudden collapse. When we approved the loan, the loan committee gave a lot of weight not only to the financial statements from 2018 but also to the ones from the prior three years; we were keenly impressed by the firm's pattern of income stability during those four calendar years. I am also attaching a copy of an article I had placed in my file a number of years back. Ever since reading the article, I have had a lingering suspicion that the story in the article is about CBF. GREEN TIMES December 13, 2019 Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities boards, had substantially overstated income and assets in contravention with General Accepted Accounting Principles. It is really too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain Glen Oak, Green. In a surprise move yesterday, twelve staff accountants at Dash Spencer, LLP left the firm and joined a competitor, Pillsbury \& Skadden. In an interview with one of the twelve former auditors, it was learned that the departure followed alleged auditing irregularities practiced by senior partners at Dash Spencer, LLP. "I have been really disillusioned with the level of scrutiny the senior managers and partners have been employing with regard to a number of audit engagements. In one case that I have worked on while I was an intern, my former manager signed off on an unqualified audit opinion where the client, a designer and manufacturer of home appliance circuit Accepted Accounting Principles. It is re too bad. I am really looking forward to joining this new firm. I believe it has a lot of potential," said one of the twelve departing accountants who wished to remain 3 Required: Assume that you are Ms. Lopez, an associate in the Loan Delinquency Department at the Booster Bank. Your supervisor would like to find out from you whether Booster Bank has a claim of negligence against the accounting firm of Dash Spencer, LLP. You have gathered additional information from the bankruptcy courts and know about the 2018 sale of stock to Easy Exchange and its accounting treatment in the income statement. Read the legal cases collected by the legal assistant and attached in the Library. Assume that the applicable precedent is from the fictional jurisdiction of the state of Green provided to you in the attached library. Assume that the financial statements audited by Dash Spencer for the calendar years of 2017, 2016, and 2015 were accurate. Prepare a report (see guidelines on the class website) for your supervisor. In preparing a report for your supervisor at Booster Bank, incorporate answers fo the questions below. Q.1. Did Dash Spencer, LLP owe a duty of care to the Bcoster Bank? Q.2 Assuming Dash Spencer LLP ewed a duty of care to the Booster Bank, dd Oash Spencer, U.P breach that duty of care? In determining whether breach occurred, make sure to perform the following accounting analysis: a. Recreate the journal entry that Circult Board Framework (CBF) made when it sold the stock to Easy Exchange. How much gain was recognized on the sale of the slock? How much cash inflow did this transaction croale for CEF? b. Calculate the present value of the note receivable using a 15% interest rate. Using the present value of the note as the coly economic benefit received, recalculate the gain or loss on the transaction. Q.3. Assume Dash Spencer. LLP breached the duty of care owed to the Booster Bank. Were damages sustained by the Booster Bank caused by Dash Spencer's breach of the duty of care? In answering this question do the following: (a) correct the 2018 income statemant using the analysis in question 2 above: (b) perform ratio analysis on the four year's income (as originalis stated and then after your corrections in requirement a) io determine if the firm actually had a patiem of income stability. Caloulate standard profitability ratios (Reburn on Sales, Gross Profit Margin, Earnings per share, plus any other analysis you wish to perform.) Q.4. In this case, there were many people who had to deal with ethical issues. Analyze the issues faced by Logan Wright, Ryan Waker, and Jasmine Young, and indicate the following for each: a. Were their actions ethicar? in each case indicate which principle or test of echics. you are applying to determine your answer. b. Indicate whether you think their actions were justified or not given the circumstances they were faced with. You may want to review section 53.01 of the AICPA Code of Prolessional Ethics. (You can review the section in the case library. Q.5. Analze this case using a strategio perspectve. In your answer cover the following a. Look at this case from the standpoint of the auditors and from your own (Nora Lopez's) standpoint. b. Knowing what you know now, which strategic prineiples would you say were ignored or misunderstoed by the auditors and yoursel? Monday, May 13, 2019, 11:07 a.m.: "Congratulations are in order! You remember that I told you last year that we would be submitting your opinion about Circuit Board Framework (CBF)'s financial statements to a bank to get some financing for our planned addition of a production facility, Don't you? Well, Booster Bank just notified me that the loan committee approved our three million dollats loan after analyzing this year's audited financial statements. The committee was really impressed that while everyone else in our industry operated at a loss or just broke even, we showed a substantial profit this period," crowed Ryan Walker, CFO of CBF, in a telephone call to Logan Wright, an auditing manager at Dash Spencer, LLP. Logan headed the audit team that issued an unqualified opinion on CBF's financial statements for each of the last four years. "That's great" Logan responded. "The loan means that you'll be able to complete that new circuit board production facility that you told me about, doesn't it? That circuit board is the product your budget shows is going to increase sales revenue and cash flow next year. It's a good thing you were able to generate a profit and get the loan. Without the new product, things looked pretty bleak." CBF designs and manufactures circuit boards for low-tech applications, such as those used in major household appliances. Sales in the appliance circuit board industry had declined or been flat in the past 18 months because of people's reluctance to buy new appliances in a poor economy. CBF's new circuit board was for washers and dryers that compete with Maytag's Neptune series. CBF's customer (a major competitor of Maytag) was launching a new washer/dryer with characteristics similar to the Neptune series, but they expected the price to be about 25% below that charged by Maytag. CBF had developed a circuit board to meet the engineering specifications of the new product but could only land the business if they had new production facilities. Jasmine Young, an auditing staff member assigned to one of Logan's jobs, overheard the conversation between Logan and Ryan on the speakerphone while sitting in Logan's office. "Logan, I didn't know that the company operated at a profit this yearl" exclaimed Jasmine. "During my fieldwork, I analyzed the monthly income statements through November, and they showed that the company operated at a loss almost every month! How did they report a substantial profit at year-end?" Logan replied, "Several years ago they made an investment in the stock of a closely held company that they thought might be a good strategic alliance. Unfortunately, that opportunity didn't work out. Until December 2018, CBF had been holding the investment and hadn't been receiving any dividends. The CFO of CBF actively searched for a company to buy the stock, and in December 2018, located a strategic buyer who took it off their hands at a substantial gainr" Logan continued. "Since CBF frequently buys and sells stock investments, the gain is a part of their income from continuing operations." "Oh, that's cleverl" Jasmine responded. "But if it were such a large transaction, why didn't they just use the cash flow from the stock sale to finance the new manufacturing facility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts