Question: BORDER POOLS Background Border Pools is a medium sized swimming pool and landscaping company located in a midsized city on the C anada/U SA border.

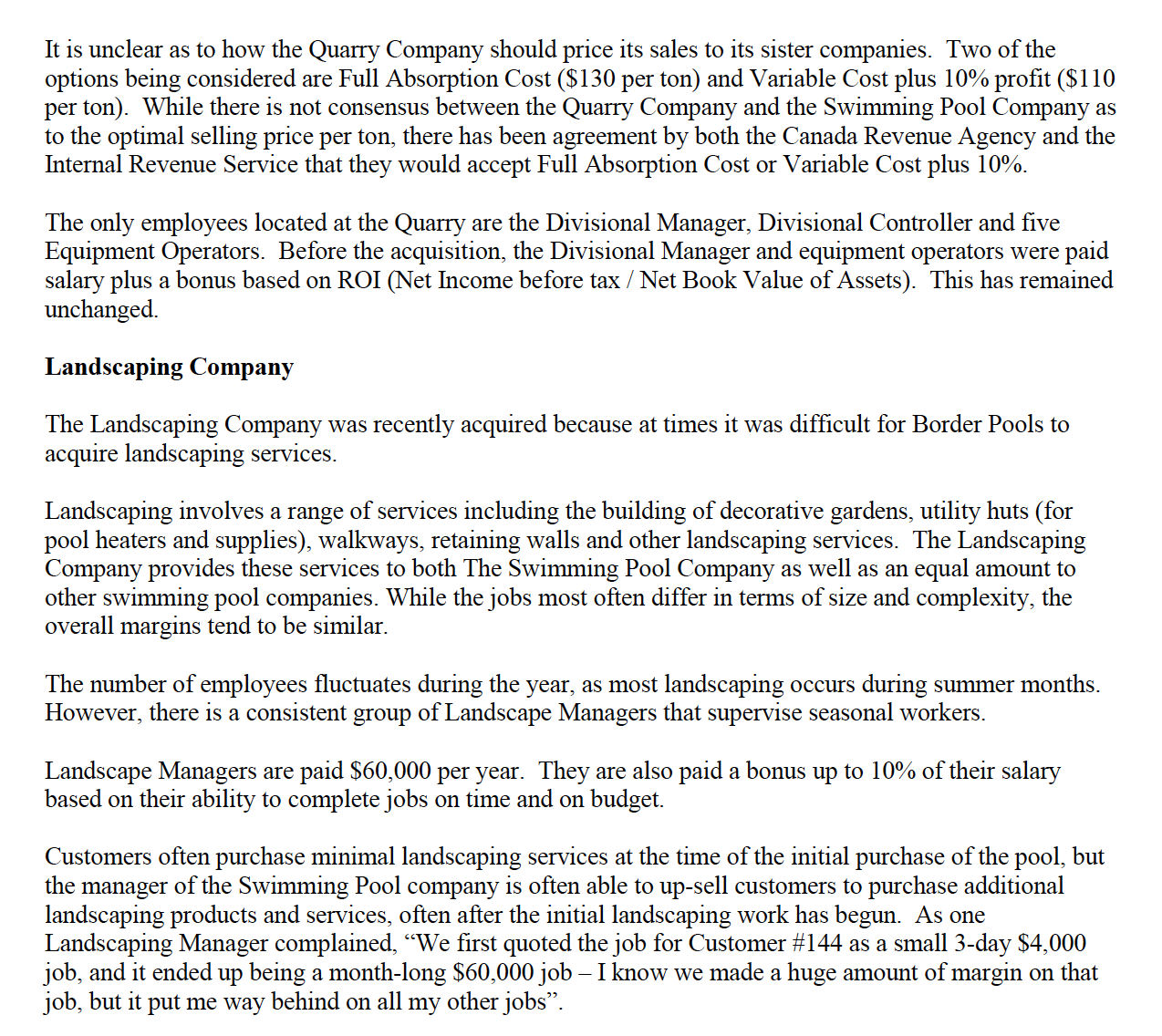

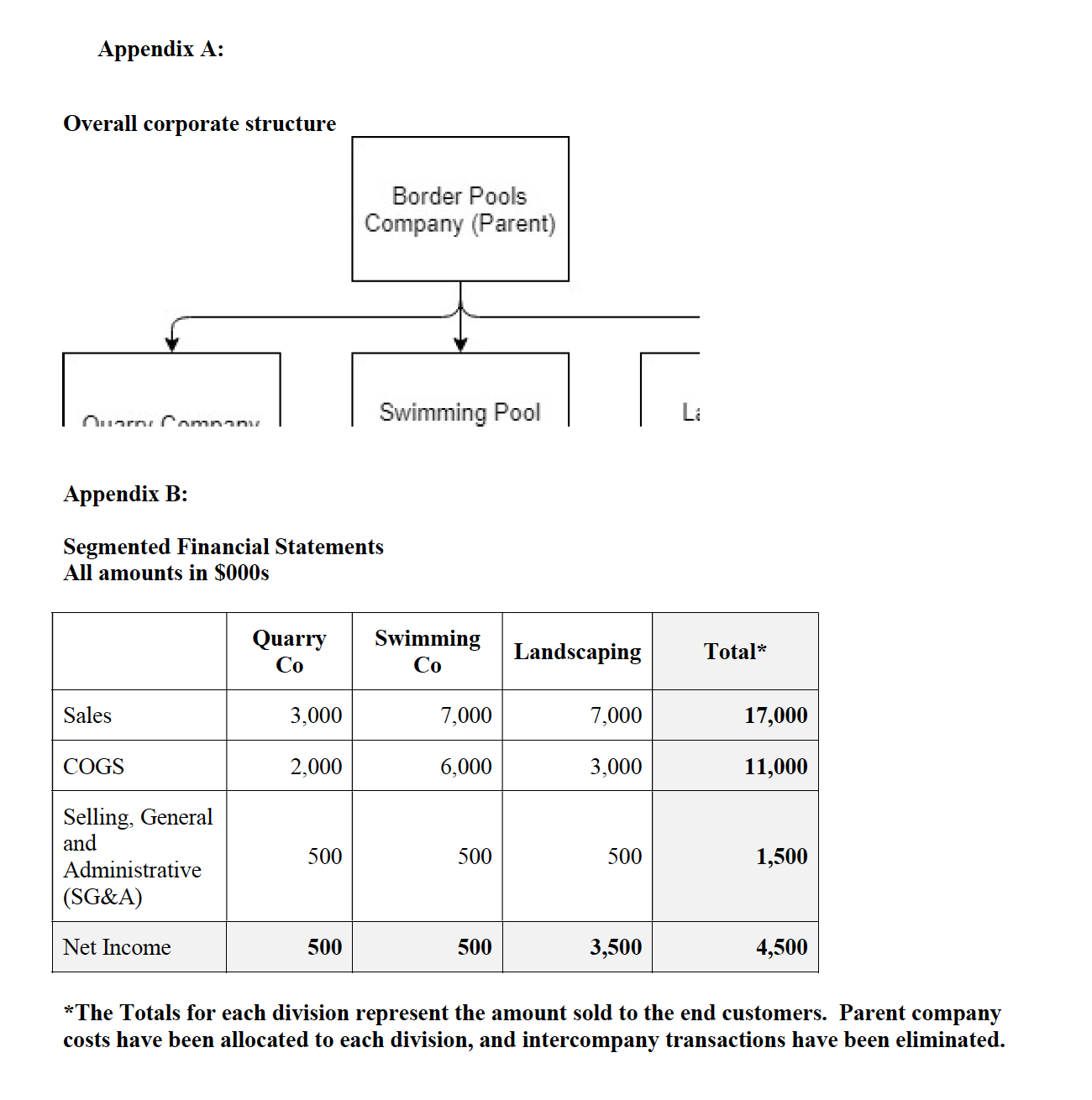

BORDER POOLS Background Border Pools is a medium sized swimming pool and landscaping company located in a midsized city on the C anada/U SA border. Border Pools recently acquired two long-time suppliers: a supplier of stone (Quarry Company), and a supplier of plants and landscaping services (Landscaping Company). As a result of these acquisitions, Border Pools reorganized into three separate divisions (Pools, Quarry and Landscaping). Each division is 100% owned by Border Pools. (see Appendix A for the overall corporate structure). Details about the parent company and each division are as follows (see Appendix B for nancial information): Border Pools (Parent) Border Pools Company was founded by the Wright brothers many years ago. Subsequent generations of family members have managed the organization, but their involvement has signicantly decreased over th years. Border Pools is 100% privately owned by various members of the Wright family. Border Pools is the parent company. As a result of the recent acquisitions and reorganization, Border Pools owns 100% of the subsidiaries: Pool Company, Quarry Company and Landscaping Company. Border Pool's ofce is located downtown. Most employees work for one of the three subsidiaries. Border Pools only has 7 employees: the company President, Chief Financial Ofcer (CFO), two administrative assistants, three divisional controllers. Border Pools is run by the President and CFO. The President of Border Pools is responsible for overall corporate strategy. All the divisional managers directly report to the President of Border Pools. The Divisional Managers have a lot of autonomy, and the Divisional Managers are responsible for setting performance targets and bonuses for their respective employees. The President is responsible for the approval of compensation of everyone else, including the Divisional Managers. The Chief Financial Ofcer (CFO) is responsible for overall fmancial reporting and tax lings (the tax rate is higher in Canada). While members of the Wright family had been active members of the board in prior years, for the last several years the only members of the board are the President and CFO. The President and CFO are paid a salary of $150,000 and $100,000, respectively. As well, they are paid an annual bonus based on their performance. The range of the bonus has increased in the last few years, and is now between 20% to 60% of their salary. The bonus is approved by the Board of Directors. The divisional controllers are co-located with each division and report to the CFO. They are responsible for assisting the Senior Managers of each division with nancial management issues and for segmented nancial reporting. They are paid between $60,000 and $90,000 per year based on the complexity of each division. Recently, the Divisional Managers have collectively requested that the Divisional Controllers no longer report directly to the CFO, but instead report to each of them respectively. Recently, the Board of directors made the decision to purchase Quarry Company and Landscaping Company these large and signicant acquisitions were financed through an increase in Border Pool's debt. This debt was negotiated with the company's bank by the Board of Directors. The Board meets on a semi-annual basis. Swimming Pool Company Number of employees: 30-60 employees (Divisional Manager, Divisional Controller, two admin assistants, six site managers, 20 year-round labourers and up to 30 seasonal labourers). The Swimming Pool Company operates out of an industrial park on the edge of the city. The main purpose of the Swimming Pool Company is to install in ground and aboveground swimming pools. While there are competitors, there always seems to be enough work to go around for everyone in the local market, and the market is very stable for these products With the assistance of the Divisional Controller, the Divisional manager is responsible for all customer relations, including the sales of swimming pool installations and selling other services such as landscaping. The Site Manager is required to negotiate prices with customers. Each installation is unique (different size, complexity, inclusion of extras like heaters, stairs and diving boards, landscaping etc). The Divisional Manager is paid $90,000 per year plus 10% of before-tax prot. The Site Mangers and two admin assistants report to the Divisional Manager. The labourers report to the Site Managers and are divided into teams. Site Managers are paid $60,000 per year and are responsible for supervising the installation of pools. Labourers are paid $25/hour. Some of the labourers work year-round, while the rest tend to be students that are only with the company for a single summer. The Site Managers are Labourers are paid a bonus at the end of each summer based on several factors, including: 0 Number of jobs completed on time. This is measured by a standard number of labour hours to install a pool. These numbers tend to be in line with industry averages and there is little variation in complexity from one installation to the next. 0 Employee turnover. This is measured based on overall employee turnover for the Swimming Pool Company. Given the seasonal nature of the work and transient nature of the workforce, the average tumover is 60% per year. 0 Number of safety incidents. This is based on the number of safety incidents reported. These factors are combined into a formula and result in bonuses up to 5% their base compensation. Very often, customers will have landscaping work done when a pool is installed. This involved the purchase of services from the Landscaping Company and decorative rocks from the Quarry Company. Prior to the acquisition of the Landscaping Company and the Quarry Company by Border Pools, the customer was simply quoted the price negotiated between the Pool Manager and the Quarry company plus a markup of 10%. It is unclear as to how the Quarry Company should price its sales to its sister companies. Two of the options being considered are Full Absorption Cost ($130 per ton) and Variable Cost plus 10% prot ($110 per ton). While there is not consensus between the Quarry Company and the Swimming Pool Company as to the optimal selling price per ton, there has been agreement by both the Canada Revenue Agency and the Internal Revenue Service that they would accept Full Absorption Cost or Variable Cost plus 10%. The only employees located at the Quarry are the Divisional Manager, Divisional Controller and ve Equipment Operators. Before the acquisition, the Divisional Manager and equipment operators were paid salary plus a bonus based on ROI (Net Income before tax / Net Book Value of Assets). This has remained unchanged. Landscaping Company The Landscaping Company was recently acquired because at times it was difcult for Border Pools to acquire landscaping services. Landscaping involves a range of services including the building of decorative gardens, utility huts (for pool heaters and supplies), walkways, retaining walls and other landscaping services. The Landscaping Company provides these services to both The Swimming Pool Company as well as an equal amount to other swimming pool companies. While the jobs most often differ in terms of size and complexity, the overall margins tend to be similar. The number of employees uctuates during the year, as most landscaping occurs during summer months. However, there is a consistent group of Landscape Managers that supervise seasonal workers. Landscape Managers are paid $60,000 per year. They are also paid a bonus up to 10% of their salary based on their ability to complete jobs on time and on budget. Customers often purchase minimal landscaping services at the time of the initial purchase of the pool, but the manager of the Swimming Pool company is often able to up-sell customers to purchase additional landscaping products and services, often after the initial landscaping work has begun. As one Landscaping Manager complained, \"We rst quoted the job for Customer #144 as a small 3day $4,000 job, and it ended up being a monthlong $60,000 job I know we made a huge amount of margin on that job, but it put me way behind on all my other jobs\". _' J. "' ___' " "J ' ______" '__ "__ ___J ' '__'_ J' _ ' ' REQUIRED: You are a consultant that the Wright family has hired for your thoughts, analysis and opinions on the following issues: 1. Should the Divisional Manager and Equipment Operators of the Quarry Company be compensated based on the same structure as before the acquisition? How should each of them be evaluated and how should each Division be evaluated? Should the reporting relationships of the Divisional Controller for the Swimming Pool Division and Quarry Division be changed? What is/are the likely reason(s) for this request from the Divisional Managers to change the reporting relationship. How should the CFO react to this request? What factors should the CFO consider? Provide an assessment of the current management control systems at the Swimming Pool Company. Are there any possible improvements? Provide an assessment of the current management control systems at the Landscaping Company. Are there any possible improvements? The Wright family would like you to recommend changes that would improve the family's governance and oversight of Border Pools. This includes possible changes to the Board of Directors, corporate structure, and/or policies and procedures. The Wright family would like you to discuss the various possible transfer pricing options between the divisions. What are the benefits and drawbacks to each option and what is the best option from the perspective of the Wright family? Appendix A: Overall corporate structure Border Pools Company (Parent) Swimming Pool L Appendix B: Segmented Financial Statements All amounts in $000s Quarry Swimming Total* Co Co Landscaping Sales 3,000 7,000 7,000 17,000 COGS 2,000 6,000 3,000 11,000 Selling, General and 500 500 500 Administrative 1,500 (SG&A) Net Income 500 500 3,500 4,500 *The Totals for each division represent the amount sold to the end customers. Parent company costs have been allocated to each division, and intercompany transactions have been eliminated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts