Question: both 12 and 13 are split into 2 pictures each. Was the only way i could het clear images.Two photos for #12 and two for

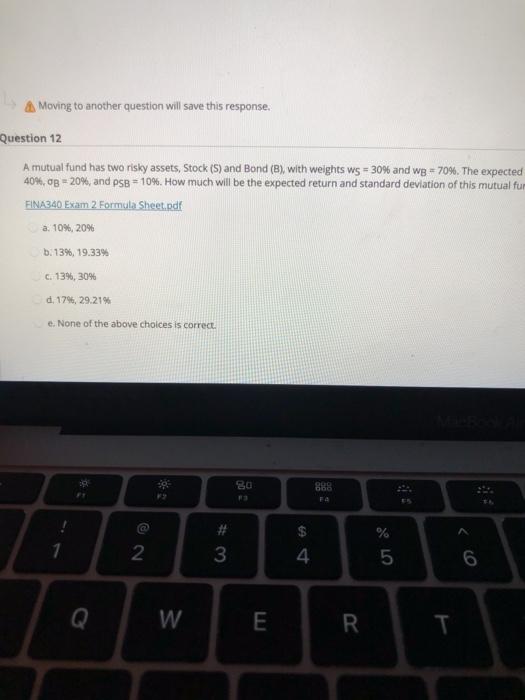

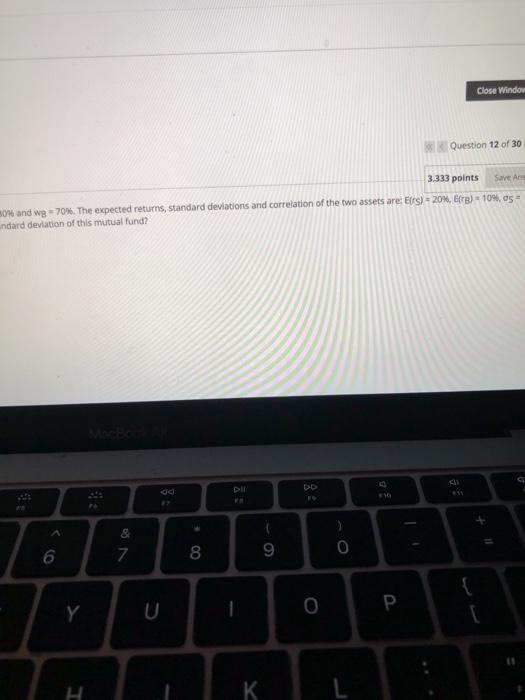

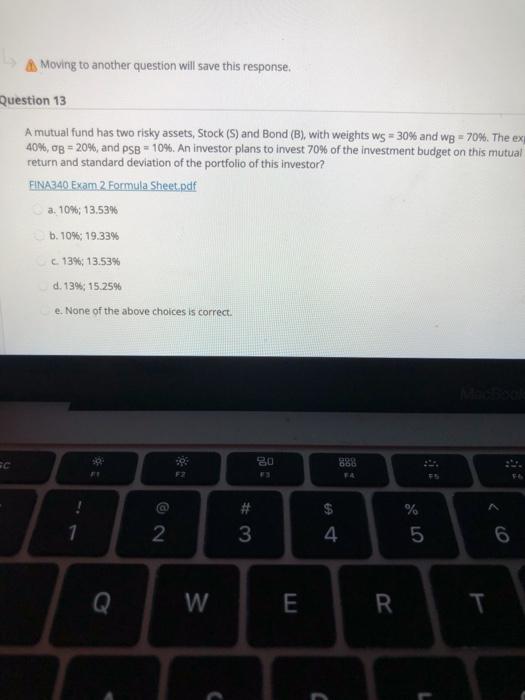

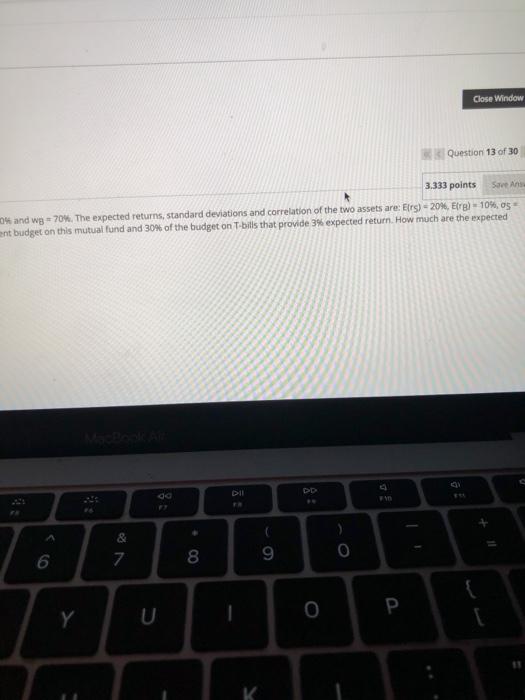

Moving to another question will save this response. Question 12 A mutual fund has two risky assets, Stock (S) and Bond (B), with weights W5 = 30% and wg = 70%. The expected 40%, 08 -20%, and PSB = 10%. How much will be the expected return and standard deviation of this mutual fur FINA340 Exam 2 Formula Sheet.pdf a. 10%, 20% b. 13%, 19.33% C. 13%, 30% d. 17%, 29.21% e. None of the above choices is correct 80 888 ! # 3 2 4 % 5 6 W E R Close Window Question 12 of 30 3.333 points Save Ang 30% and wg -70%. The expected returns, Standard deviations and correlation of the two assets are: Ers) = 20%, EB) 10%, os - ndard deviation of this mutual fund? CH Do B 8 7 6 8 9 0. Y U 1 Moving to another question will save this response. Question 13 A mutual fund has two risky assets, Stock (S) and Bond (B), with weights Ws = 30% and wg = 70%. The ex 40%, OB = 20%, and PSB - 10%. An investor plans to invest 70% of the investment budget on this mutual return and standard deviation of the portfolio of this investor? FINA340 Exam 2 Formula Sheet.pdf a. 10%; 13.53% b. 10%; 19.33% 13%; 13.53% d. 13%; 15.25% e. None of the above choices is correct. C 80 FA a # 3 1 $ 4 % 5 2 6 W E R C Close Window Question 13 of 30 3.333 points Save A 0% and wg - 70%. The expected returns, standard deviations and correlation of the two assets are: Ers) -20%, Erg) - 10.05 ant budget on this mutual fund and 30% of the budget on T-bills that provide 3% expected return. How much are the expected Dll & 6 O 7 8 9 T U K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts