Question: both answers, quickly please! (b) Mark plc. is proposing a one-for-five rights issue. The market price of the share is expected to be 320 pence

both answers, quickly please!

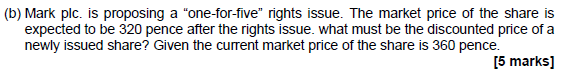

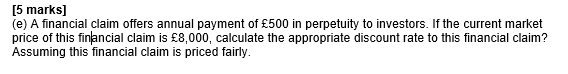

(b) Mark plc. is proposing a "one-for-five" rights issue. The market price of the share is expected to be 320 pence after the rights issue. what must be the discounted price of a newly issued share? Given the current market price of the share is 360 pence. [5 marks] [5 marks] (e) A financial claim offers annual payment of 500 in perpetuity to investors. If the current market price of this financial claim is 8,000, calculate the appropriate discount rate to this financial claim? Assuming this financial claim is priced fairly. (b) Mark plc. is proposing a "one-for-five" rights issue. The market price of the share is expected to be 320 pence after the rights issue. what must be the discounted price of a newly issued share? Given the current market price of the share is 360 pence. [5 marks] [5 marks] (e) A financial claim offers annual payment of 500 in perpetuity to investors. If the current market price of this financial claim is 8,000, calculate the appropriate discount rate to this financial claim? Assuming this financial claim is priced fairly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts