Question: both are same questions Question 4 A. The Bake with Joy Company has requested a cash budget for June. After examining the records of the

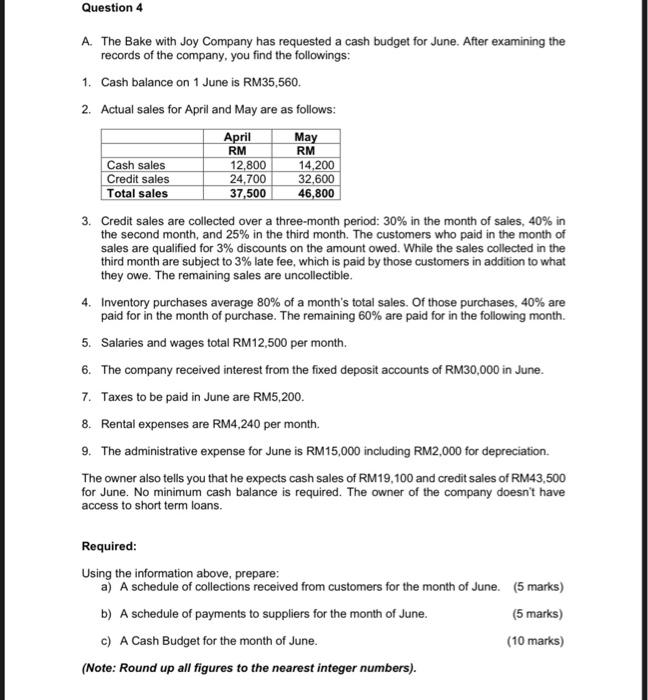

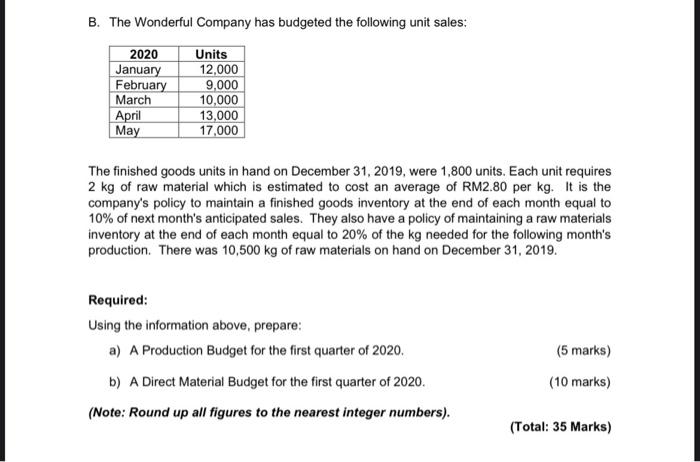

Question 4 A. The Bake with Joy Company has requested a cash budget for June. After examining the records of the company, you find the followings: 1. Cash balance on 1 June is RM35,560. 2. Actual sales for April and May are as follows: April May RM RM Cash sales 12,800 14,200 Credit sales 24,700 32,600 Total sales 37,500 46,800 3. Credit sales are collected over a three-month period: 30% in the month of sales, 40% in the second month, and 25% in the third month. The customers who paid in the month of sales are qualified for 3% discounts on the amount owed. While the sales collected in the third month are subject to 3% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible. 4. Inventory purchases average 80% of a month's total sales. Of those purchases, 40% are paid for in the month of purchase. The remaining 60% are paid for in the following month. 5. Salaries and wages total RM12,500 per month. 6. The company received interest from the fixed deposit accounts of RM30,000 in June. 7. Taxes to be paid in June are RM5,200. 8. Rental expenses are RM4,240 per month. 9. The administrative expense for June is RM15,000 including RM2,000 for depreciation. The owner also tells you that he expects cash sales of RM19,100 and credit sales of RM43,500 for June. No minimum cash balance is required. The owner of the company doesn't have access to short term loans. Required: Using the information above, prepare: a) A schedule of collections received from customers for the month of June. (5 marks) b) A schedule of payments to suppliers for the month of June. (5 marks) C) A Cash Budget for the month of June. (10 marks) (Note: Round up all figures to the nearest integer numbers). B. The Wonderful Company has budgeted the following unit sales: 2020 January February March April May Units 12,000 9,000 10,000 13,000 17,000 The finished goods units in hand on December 31, 2019, were 1,800 units. Each unit requires 2 kg of raw material which is estimated to cost an average of RM2.80 per kg. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 10% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 20% of the kg needed for the following month's production. There was 10,500 kg of raw materials on hand on December 31, 2019. Required: Using the information above, prepare: a) A Production Budget for the first quarter of 2020. b) A Direct Material Budget for the first quarter of 2020. (Note: Round up all figures to the nearest integer numbers). (5 marks) (10 marks) (Total: 35 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts