Question: both Average and FIFO method wanted Fatima Co. incurred the following transactions during the month of December 2019. December 1: Beginning Inventory (400 units @

both Average and FIFO method wanted

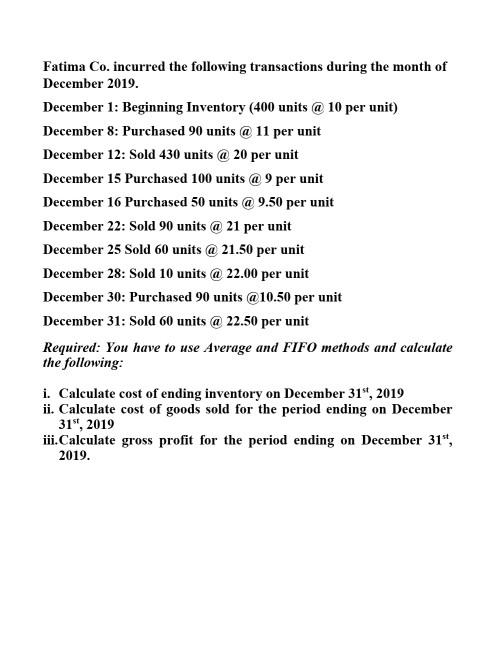

Fatima Co. incurred the following transactions during the month of December 2019. December 1: Beginning Inventory (400 units @ 10 per unit) December 8: Purchased 90 units @ 11 per unit December 12: Sold 430 units @ 20 per unit December 15 Purchased 100 units @ 9 per unit December 16 Purchased 50 units @ 9.50 per unit December 22: Sold 90 units @ 21 per unit December 25 Sold 60 units @ 21.50 per unit December 28: Sold 10 units @ 22.00 per unit December 30: Purchased 90 units @10.50 per unit December 31: Sold 60 units @ 22.50 per unit Required: You have to use Average and FIFO methods and calculate the following: i. Calculate cost of ending inventory on December 31, 2019 ii. Calculate cost of goods sold for the period ending on December 31", 2019 iii.Calculate gross profit for the period ending on December 31", 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts