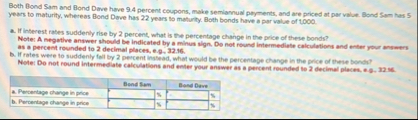

Question: Both Bond Sam and Bond Dave have 9 . 4 percent coupons, make semiannual peyments, and are priced at par value. Bond Sam has 5

Both Bond Sam and Bond Dave have percent coupons, make semiannual peyments, and are priced at par value. Bond Sam has years to maturity, whereas Bond Dave has years to maturity. Both bonds heve is par vabue of

a If inberest rabes suddenly rise by percent, what is the percentage change in the price of these bonds?

Note: A negative answer shovid be indicated by a minus sign. De not round intermediate calculations and anter your avsoers as a percent rounded to decimal places, eg

b If rates were to suddenty fall by percent inshead, what would be the percentape change in the pice of these bonact?

Noter Do not round intermediatp catculations and eeller your answer as a percent rounded le decimal places, a is i sc

tableBond Sem,Bond Bave Percertage change in price,b Percertape chavge in price,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock