Question: both decrease just need the amounts and work Mr. Young operates a photography studio as a sole proprietorship. His average annual income from the business

both decrease just need the amounts and work

both decrease just need the amounts and work

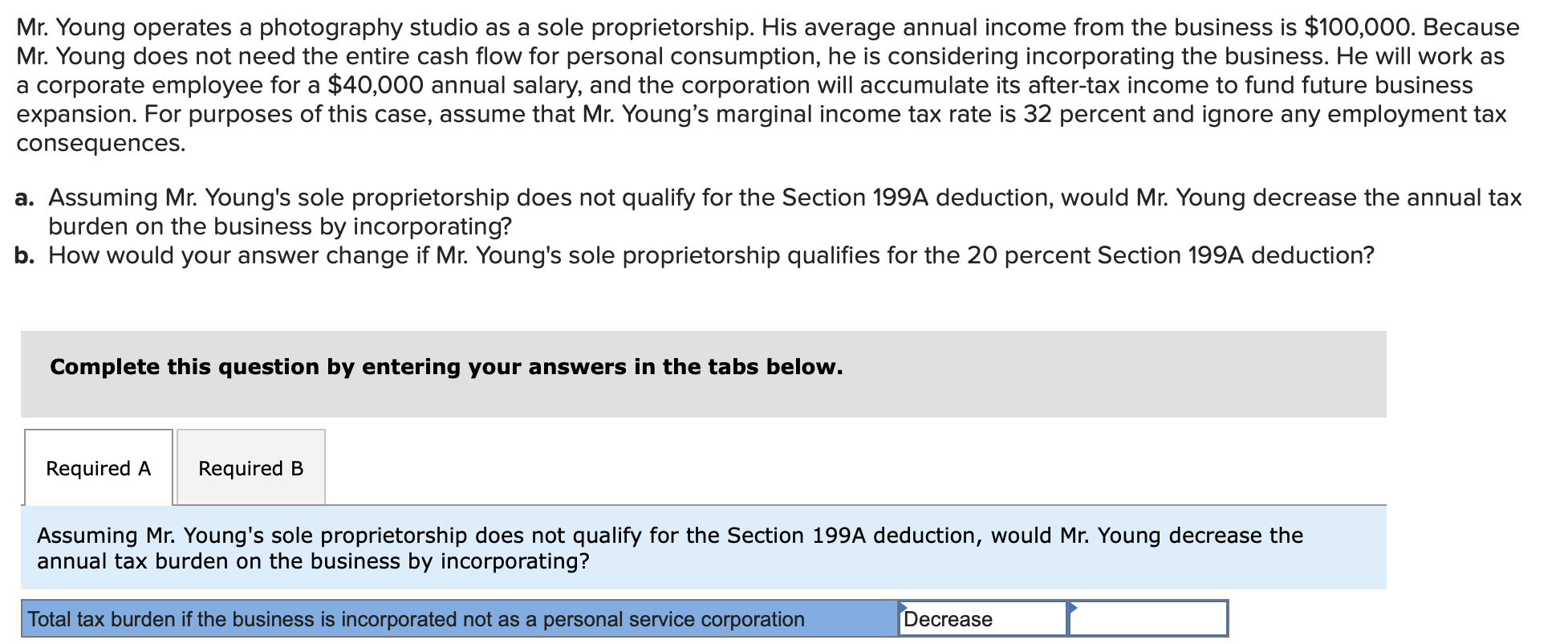

Mr. Young operates a photography studio as a sole proprietorship. His average annual income from the business is $100,000. Because Mr. Young does not need the entire cash flow for personal consumption, he is considering incorporating the business. He will work as a corporate employee for a $40,000 annual salary, and the corporation will accumulate its after-tax income to fund future business expansion. For purposes of this case, assume that Mr. Young's marginal income tax rate is 32 percent and ignore any employment tax consequences a. Assuming Mr. Young's sole proprietorship does not qualify for the Section 199A deduction, would Mr. Young decrease the annual tax burden on the business by incorporating? b. How would your answer change if Mr. Young's sole proprietorship qualifies for the 20 percent Section 199A deduction? Complete this question by entering your answers in the tabs below. Required A Required B Assuming Mr. Young's sole proprietorship does not qualify for the Section 199A deduction, would Mr. Young decrease the annual tax burden on the business by incorporating? Decrease Total tax burden if the business is incorporated not as a personal service corporation Mr. Young operates a photography studio as a sole proprietorship. His average annual income from the business is $100,000. Because Mr. Young does not need the entire cash flow for personal consumption, he is considering incorporating the business. He will work as a corporate employee for a $40,000 annual salary, and the corporation will accumulate its after-tax income to fund future business expansion. For purposes of this case, assume that Mr. Young's marginal income tax rate is 32 percent and ignore any employment tax consequences a. Assuming Mr. Young's sole proprietorship does not qualify for the Section 199A deduction, would Mr. Young decrease the annual tax burden on the business by incorporating? b. How would your answer change if Mr. Young's sole proprietorship qualifies for the 20 percent Section 199A deduction? Complete this question by entering your answers in the tabs below. Required A Required B Assuming Mr. Young's sole proprietorship does not qualify for the Section 199A deduction, would Mr. Young decrease the annual tax burden on the business by incorporating? Decrease Total tax burden if the business is incorporated not as a personal service corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts