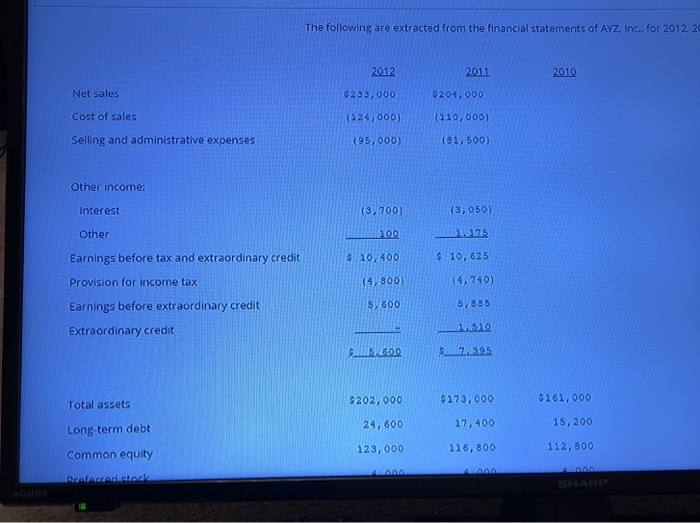

Question: both for the same given The following are extracted from the financial statements of AYZ, Inc., for 2012, 2 2012 2011 2010 Net sales $233,000

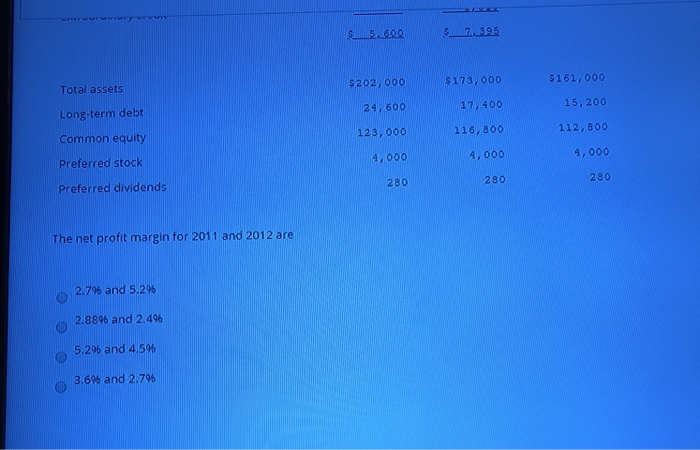

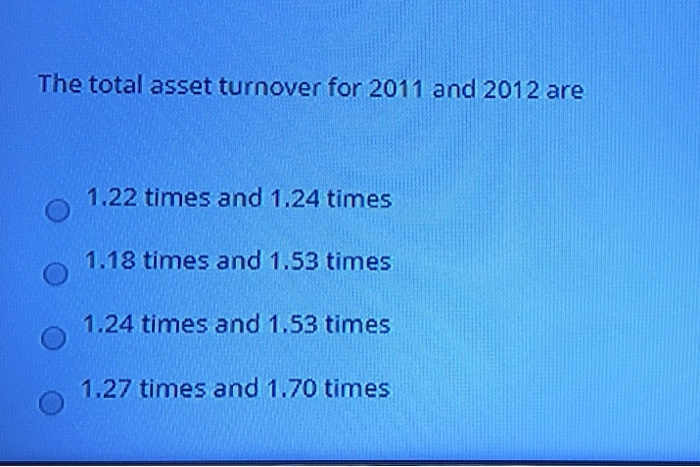

The following are extracted from the financial statements of AYZ, Inc., for 2012, 2 2012 2011 2010 Net sales $233,000 $204,000 Cost of sales (124,000) (110,000) Selling and administrative expenses (95,000) (81, 500) Other income: Interest (3,700) (3,050) Other 1175 Earnings before tax and extraordinary credit $ 10,400 $ 10, 625 Provision for income tax (4, 800) (4,740) 5,600 5,885 Earnings before extraordinary credit Extraordinary credit 1,50 S5600 77,1395 Total assets $ 202,000 $173,000 $161,000 24,600 17,400 15,200 Long-term debt 123,000 116,800 112,800 Common equity Raaditaal SHARP $ 5.600 $ 1995 $ 202,000 $173,000 $161,000 Total assets 24,600 17,400 15, 200 Long-term debt 116, 800 112, 800 123,000 Common equity 4,000 4,000 4,000 Preferred stock 280 280 280 Preferred dividends The net profit margin for 2011 and 2012 are 2.796 and 5.296 2.8896 and 2.496 5.296 and 4.596 3.695 and 2.796 The total asset turnover for 2011 and 2012 are 1.22 times and 1.24 times 1.18 times and 1.53 times 1.24 times and 1.53 times 1.27 times and 1.70 times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts