Question: both images are for the same question. thanks :) Notes to the Trial Balance 1. Depreciation is to be charged on the following basis a.

both images are for the same question. thanks :)

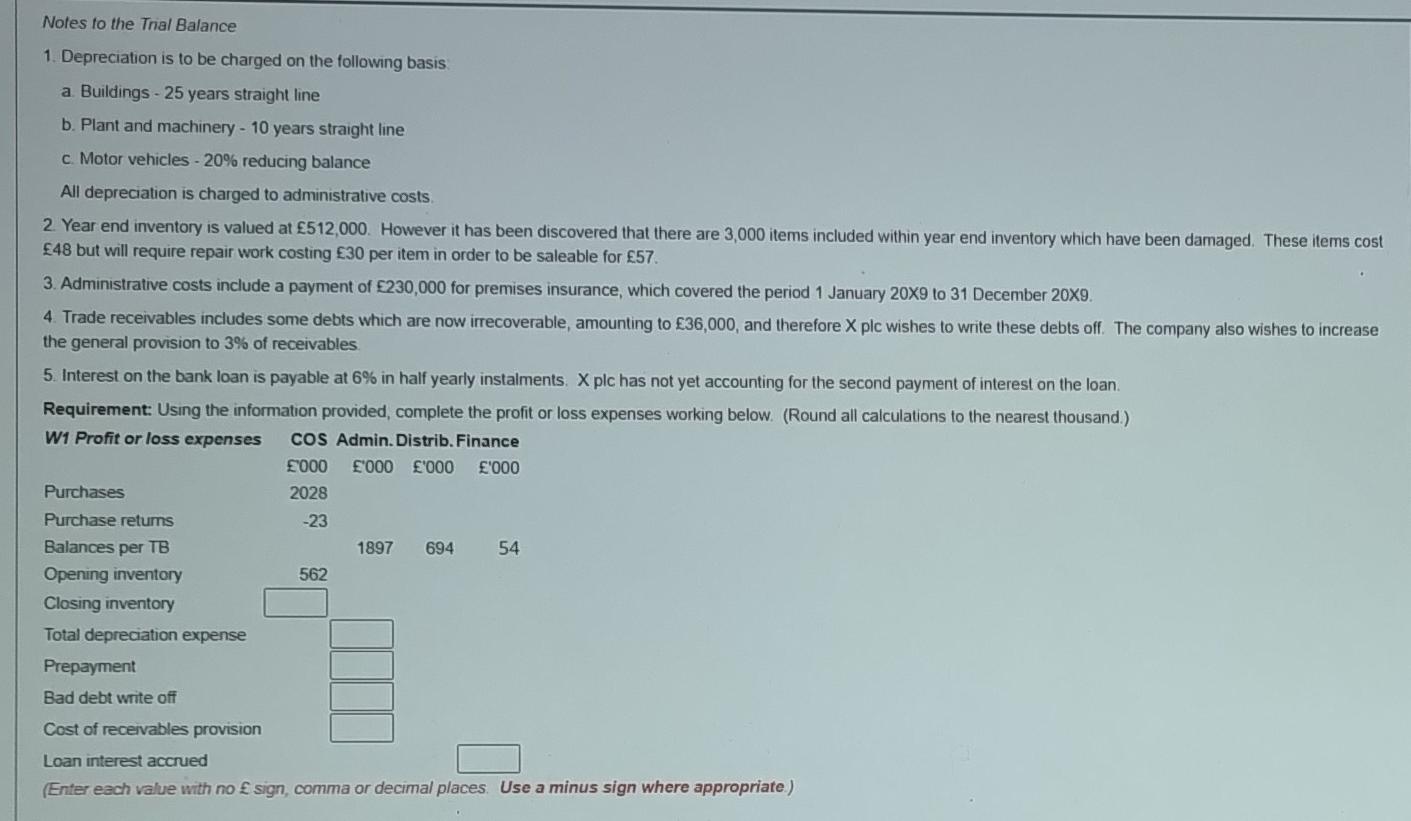

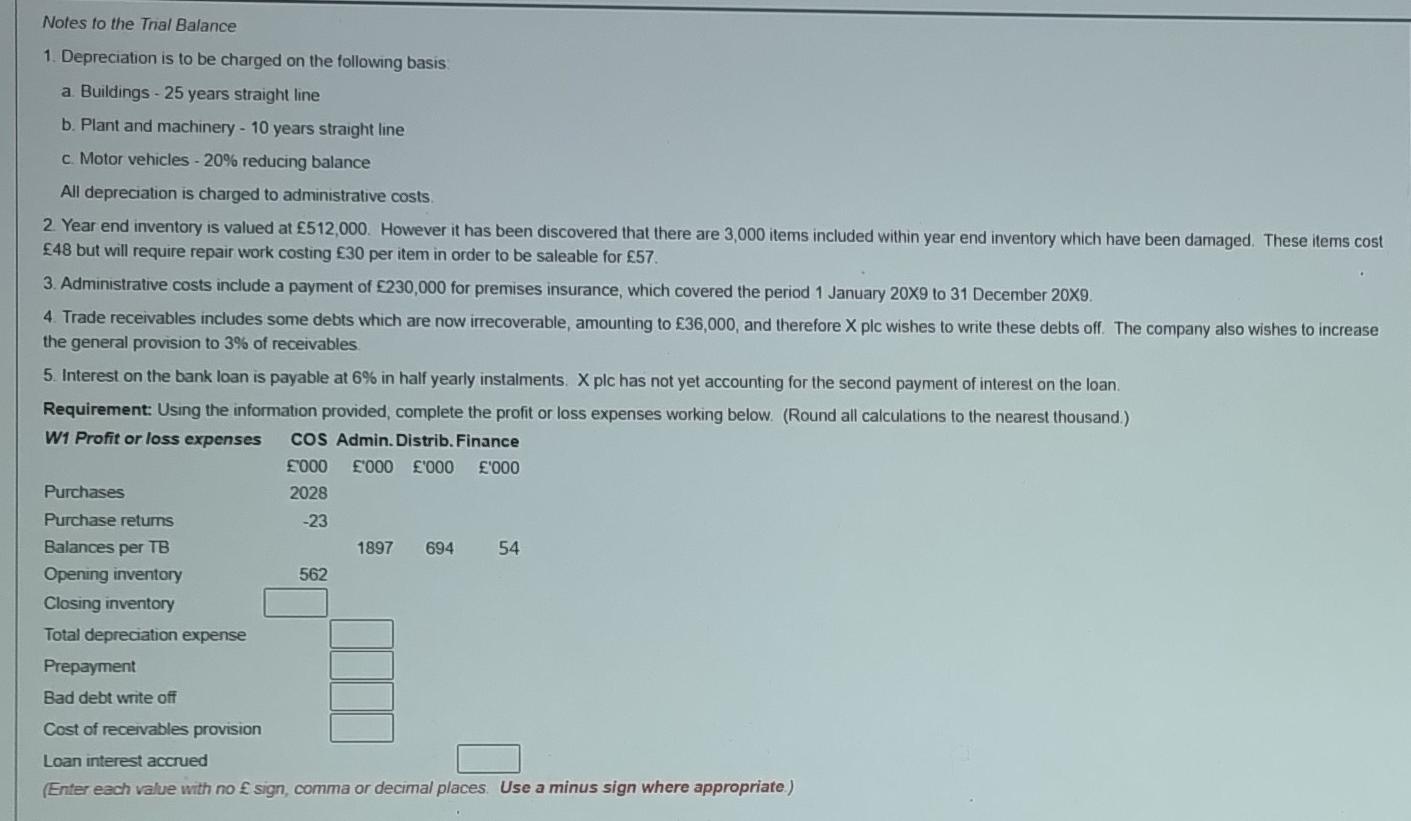

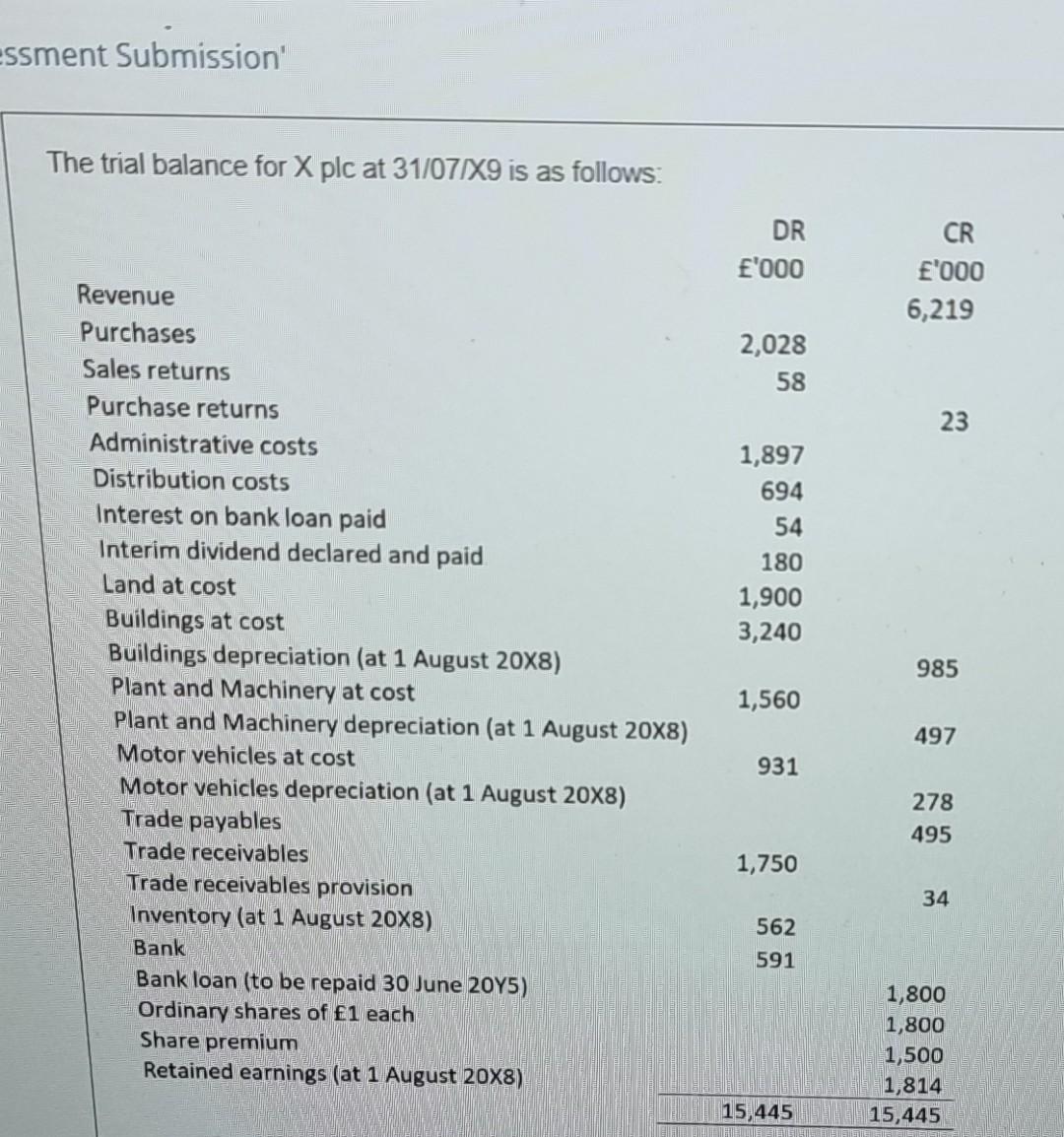

Notes to the Trial Balance 1. Depreciation is to be charged on the following basis a. Buildings 25 years straight line b. Plant and machinery - 10 years straight line c. Motor vehicles - 20% reducing balance All depreciation is charged to administrative costs. 2. Year end inventory is valued at 512,000. However it has been discovered that there are 3,000 items included within year end inventory which have been damaged. These items cost 48 but will require repair work costing 30 per item in order to be saleable for 57. 3. Administrative costs include a payment of 230,000 for premises insurance, which covered the period 1 January 209 to 31 December 209. 4. Trade receivables includes some debts which are now irrecoverable, amounting to 36,000, and therefore X plc wishes to write these debts off. The company also wishes to increase the general provision to 3% of receivables. 5. Interest on the bank loan is payable at 6% in half yearly instalments. X plc has not yet accounting for the second payment of interest on the loan. Requirement: Using the information provided, complete the profit or loss expenses working below. (Round all calculations to the nearest thousand.) (Enter each value with no E sign, comma or decimal places. Use a minus sign where appropriate) Notes to the Trial Balance 1. Depreciation is to be charged on the following basis a. Buildings 25 years straight line b. Plant and machinery - 10 years straight line c. Motor vehicles - 20% reducing balance All depreciation is charged to administrative costs. 2. Year end inventory is valued at 512,000. However it has been discovered that there are 3,000 items included within year end inventory which have been damaged. These items cost 48 but will require repair work costing 30 per item in order to be saleable for 57. 3. Administrative costs include a payment of 230,000 for premises insurance, which covered the period 1 January 209 to 31 December 209. 4. Trade receivables includes some debts which are now irrecoverable, amounting to 36,000, and therefore X plc wishes to write these debts off. The company also wishes to increase the general provision to 3% of receivables. 5. Interest on the bank loan is payable at 6% in half yearly instalments. X plc has not yet accounting for the second payment of interest on the loan. Requirement: Using the information provided, complete the profit or loss expenses working below. (Round all calculations to the nearest thousand.) (Enter each value with no E sign, comma or decimal places. Use a minus sign where appropriate) Ssment Submission' The trial balance for X plc at 31/07/X X is as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts