Question: Both photos are same problem. Please help thank you. In June 2015, Wendy Winger organized a corporation to provide aerial photography services. The company, called

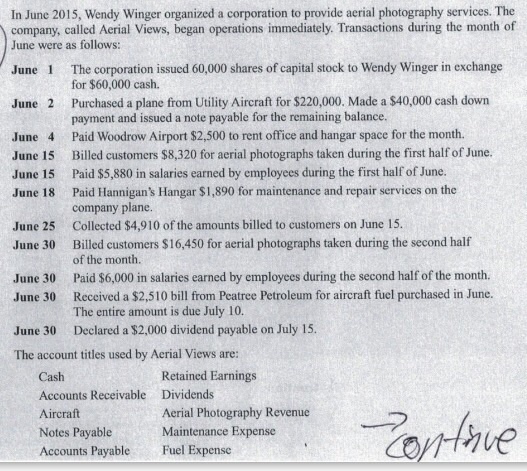

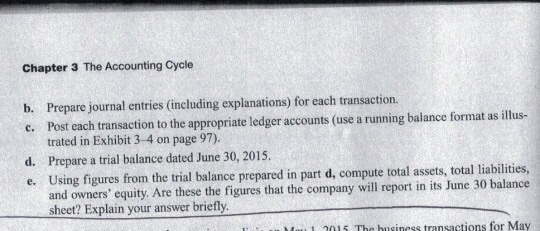

In June 2015, Wendy Winger organized a corporation to provide aerial photography services. The company, called Acrial Views, began operations immediately. Transactions during the month of June were as follows: June 1 The corporation issued 60,000 shares of capital stock to Wendy Winger in exchange for $60,000 cash. Purchased a plane from Utility Aircraft for $220,000. Made a $40,000 cash down payment and issued a note payable for the remaining balance. Paid Woodrow Airport $2,500 to rent office and hangar space for the month. Billed customers $8,320 for aerial photographs taken during the first half of June. Paid $5,880 in salaries earned by employees during the first half of June. Paid Hannigan's Hangar $1,890 for maintenance and repair services on the company plane. Collected $4,910 of the amounts billed to customers on June 15. Billed customers $16,450 for aerial photographs taken during the second half of the month. Paid $6,000 in salaries earned by employees during the second half of the month. Received a $2,510 bill from Peatree Petroleum for aircraft fuel purchased in June. June 2 June 4 June 15 June 15 June 18 June 25 June 30 June 30 June 30 The entire amount is due July 10. June 30 Declared a $2,000 dividend payable on July 15 The account titles used by Aerial Views are: Cash Accounts Receivable Dividends Aircraft Notes Payable Accounts PayableFuel Expense Retained Earnings Aerial Photography Revenue Maintenance Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts