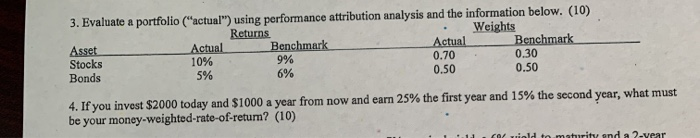

Question: both please 3. Evaluate a portfolio (actual) using performance attribution analysis and the information below. (10) Returns Weights Asset Actual Benchmark Actual Benchmark Stocks 10%

3. Evaluate a portfolio ("actual") using performance attribution analysis and the information below. (10) Returns Weights Asset Actual Benchmark Actual Benchmark Stocks 10% 9% 0.70 0.30 Bonds 5% 6% 0.50 0.50 4. If you invest $2000 today and $1000 a year from now and earn 25% the first year and 15% the second year, what must be your money-weighted-rate-of-retum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts