Question: both pls Question 57 (1 point) Dixie Company's defined benefit pension plan utilizes a funding formula that considers years of service and average compensation over

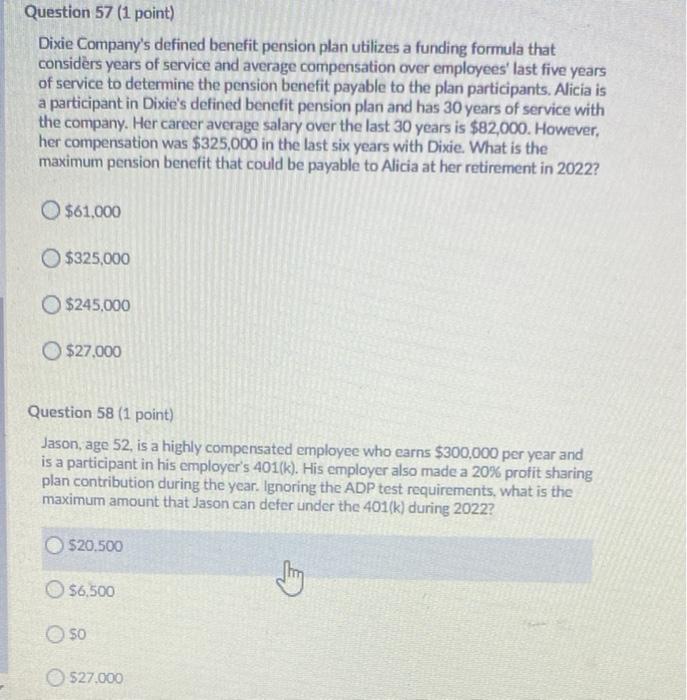

Question 57 (1 point) Dixie Company's defined benefit pension plan utilizes a funding formula that considers years of service and average compensation over employees' last five years of service to determine the pension benefit payable to the plan participants, Alicia is a participant in Dixie's defined benefit pension plan and has 30 years of service with the company. Her career average salary over the last 30 years is $82,000. However, her compensation was $325,000 in the last six years with Dixie. What is the maximum pension benefit that could be payable to Alicia at her retirement in 2022? O $61,000 $325,000 $245,000 O $27,000 Question 58 (1 point) Jason, age 52, is a highly compensated employee who earns $300,000 per year and is a participant in his employer's 401(k). His employer also made a 20% profit sharing plan contribution during the year. Ignoring the ADP test requirements, what is the maximum amount that Jason can defer under the 401(k) during 2022? $20.500 $6,500 $0 $27.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts