Question: both question 24 & 25 please and thanks Question 24 9.12 pts One essential difference between a debt financial instrument and a common equity financial

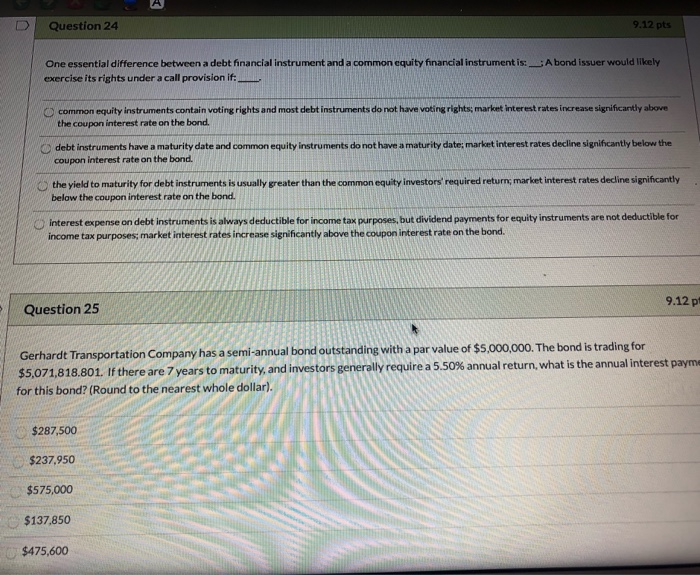

Question 24 9.12 pts One essential difference between a debt financial instrument and a common equity financial instrumentis exercise its rights under a call provision if: __ A bond issuer would likely common equity instruments contain voting rights and most debt instruments do not have voting rights, market interest rates increase significantly above the coupon interest rate on the bond. debt instruments have a maturity date and common equity instruments do not have a maturity date market interest rates decline significantly below the coupon interest rate on the bond. the yield to maturity for debt instruments is usually greater than the common equity investors' required return market interest rates decline significantly below the coupon interest rate on the bond. interest expense on debt instruments is always deductible for income tax purposes, but dividend payments for equity instruments are not deductible for income tax purposes, market interest rates increase significantly above the coupon interest rate on the bond. Question 25 9.12 Gerhardt Transportation Company has a semi-annual bond outstanding with a par value of $5,000,000. The bond is trading for $5,071,818.801. If there are 7 years to maturity, and investors generally require a 5.50% annual return, what is the annual interest paym for this bond? (Round to the nearest whole dollar). $287,500 $237,950 $575,000 $137,850 $475,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts