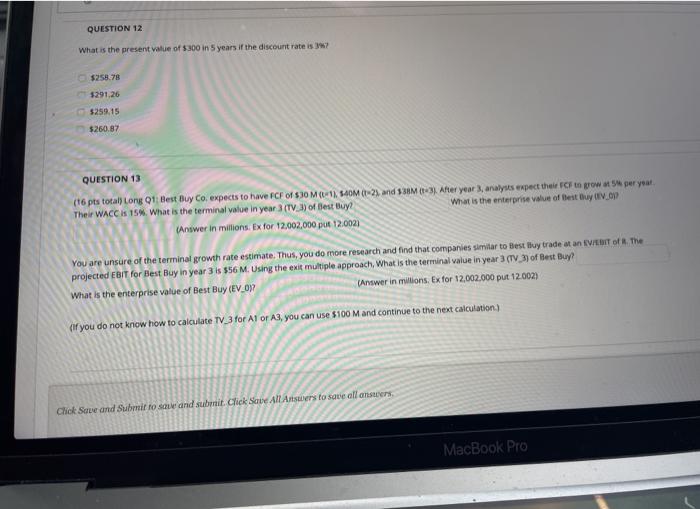

Question: both questions please QUESTION 12 What is the present Value of $300 in 5 years if the discount rate is 17 $258.78 3291.26 5259.15 $260.87

QUESTION 12 What is the present Value of $300 in 5 years if the discount rate is 17 $258.78 3291.26 5259.15 $260.87 QUESTION 13 (16 pts totaly Long 01 Best Buy Co. expects to have FCF of $30 M(1), 540M (2) and 330M - After year 3, analysts expect the FCF to power your Their WACC is 15%. What is the terminal value in year 3 (TV3) of Best Buy What is the enterprise value of Best Buy V_01 (Answer in millions. Ex for 12.002,000 put 12.0021 You are unsure of the terminal growth rate estimate. Thus, you do more research and find that companies similar to Best luy trade at an VERIT of R. The projected EBIT for Best Buy in year 3 is $56 M. Using the exit multiple approach, What is the terminal value in year 3 (TV3) of Best Buy? What is the enterprise value of Best Buy (EV_02 Answer in millions. Ex for 12.002.000 put 12.002) (if you do not know how to calculate TV 3 for A1 or A3, you can use $100 M and continue to the next calculation) Chick Save and Submit to souvand submit. Click Save All Artters to save all onsters MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts