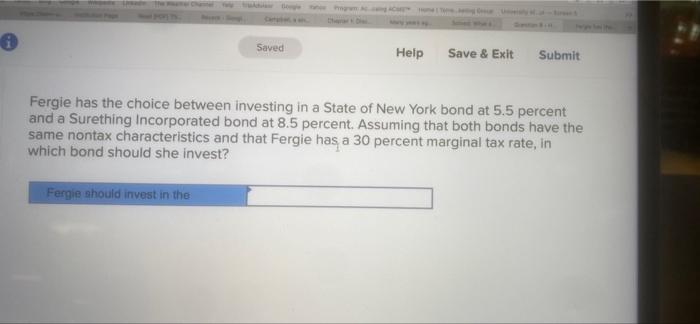

Question: both questions please Saved Help Save & Exit Submit Fergie has the choice between investing in a State of New York bond at 5.5 percent

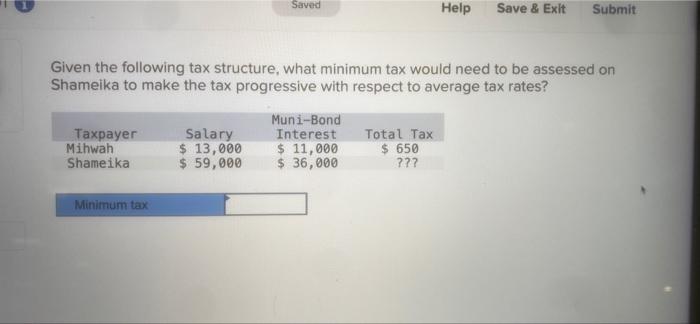

Saved Help Save & Exit Submit Fergie has the choice between investing in a State of New York bond at 5.5 percent and a Surething Incorporated bond at 8.5 percent. Assuming that both bonds have the same nontax characteristics and that Fergie has a 30 percent marginal tax rate, in which bond should she invest? Fergie should invest in the Saved Help Save & Exit Submit Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Muni-Bond Taxpayer Salary Interest Total Tax Mihwah $ 13,000 $ 11,000 $ 650 Shameika $ 59,000 $ 36,000 ??? Minimum tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts