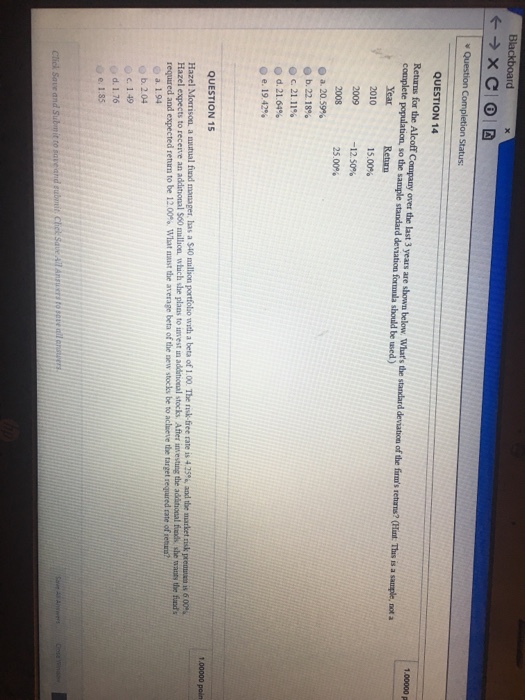

Question: Both questions please. Status: QUESTION 14 Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation of the

Status: QUESTION 14 Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation of the firm's retharns? (Hant. Ths is a sample, not a complete population, so the sample standard deviation formala should be used) 1.00000 p 2010 15.00% -12.50% 25.00% @a. 20 59% Ob, 22.18% ?. 21.11% d. 21.64% QUESTION 15 Hazel M tisou a n tual fund manager, has a SO malls n portfolio with a beta of 1.00. The n k-fiee rate is 425% a d the market m an s 600 e and expected return to be i 2.00% wiat nast te average beta ofthe new stocks be to acheve the target requred rate ofetm? a. 1.94 C. 1.49 d. 1.76 Cliek Save and Submit to save and s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts