Question: Both thanks ! a o IS E3-2 In its first year of operations, Brisson Company earned $26,000 in service revenue. Of this amount, $4,000 was

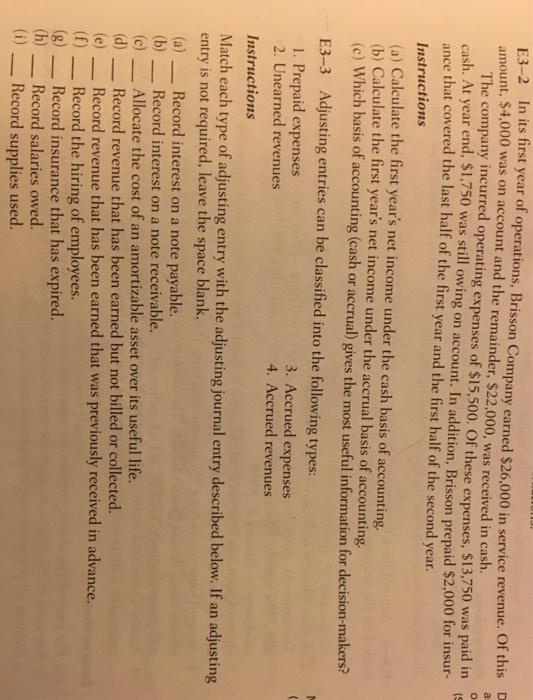

a o IS E3-2 In its first year of operations, Brisson Company earned $26,000 in service revenue. Of this amount, $4,000 was on account and the remainder, $22,000, was received in cash. The company incurred operating expenses of $15,500. Of these expenses, $13,750 was paid in cash. At year end, $1.750 was still owing on account. In addition, Brisson prepaid $2,000 for insur- ance that covered the last half of the first year and the first half of the second year. Instructions (a) Calculate the first year's net income under the cash basis of accounting. (b) Calculate the first year's net income under the accrual basis of accounting. (c) Which basis of accounting (cash or accrual) gives the most useful information for decision-makers? E3-3 Adjusting entries can be classified into the following types: 1. Prepaid expenses 3. Accrued expenses 2. Unearned revenues 4. Accrued revenues Instructions Match each type of adjusting entry with the adjusting journal entry described below. If an adjusting entry is not required, leave the space blank. (a) Record interest on a note payable. (b) Record interest on a note receivable. (c) Allocate the cost of an amortizable asset over its useful life. (d) Record revenue that has been earned but not billed or collected. (e) Record revenue that has been earned that was previously received in advance. Record the hiring of employees. Record insurance that has expired. (h Record salaries owed. Record supplies used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts