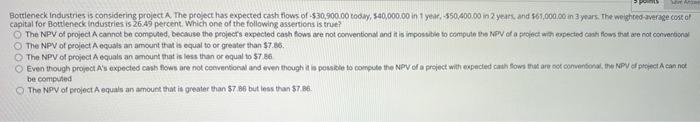

Question: Bottleneck Industries is considering project A. The project has expected cash flows of $30,900.00 today, 540,000.00 in year, -550,400.00 in 2 years and 561,000.00 13

Bottleneck Industries is considering project A. The project has expected cash flows of $30,900.00 today, 540,000.00 in year, -550,400.00 in 2 years and 561,000.00 13 years. The weighted average cost of capital for Bottleneck Industries is 26.49 percent. Which one of the following assertions is true? The NPV of project cannot be computed, because the projects expected cash flows are not corwentional and it is imposible to compute the ev of a project with uspected cash flows that are not conventional The NPV of project A equals an amount that is equal to or greater than $7.86. The NPV of project equals an amount that is less than or equal to 57.86 Even though project As expected cash flows are not conventional and even though it is possible to compute the NPV of a project with expected cathows that are of conventional, the NPV of project can not be computed The NPV of project Aequins an amount that is greater than $7 86 but less than $7.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts