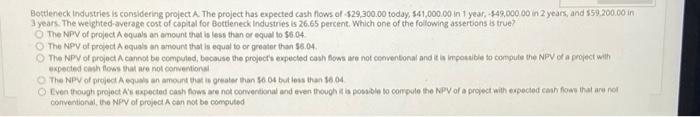

Question: Bottleneck Industries is considering project A. The project has expected cash flows of -$29,300.00 today, $41,000.00 in 1 year, -$49,000.00 in 2 years, and $59,200.00

Boctieneck industries is considering project A. The project has expected cash flows of 529,300.00 today, 541,000.00 in 1 year, $49.000,00 in 2 years, and 559.200 .00 in 3 years. The weighted-ayerage cost of captal for Bottieneck industries is 26.65 percent. Which one of the following assertions is true? The NPV of project A equals an amount that is less than or equal to 5604 The Nipy of project A equals an amount that is equal to or greater than 55.04 . The NPN of projoct A cannot be compuled, becouse the projects expected cash fows me not conventonal and it is impostible to compute the NPV of a propect with expected cash dows that are not conventional The NPV of project A equais an amount that is oreater than 56.04 but less than 16.04 conyentional, the NPY of project A cabn not be computed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts