Question: bottom 3 question possible answers (High or Low) 2. Current asset financing policies Aa Aa How do firms finance their operating current assets? A firm's

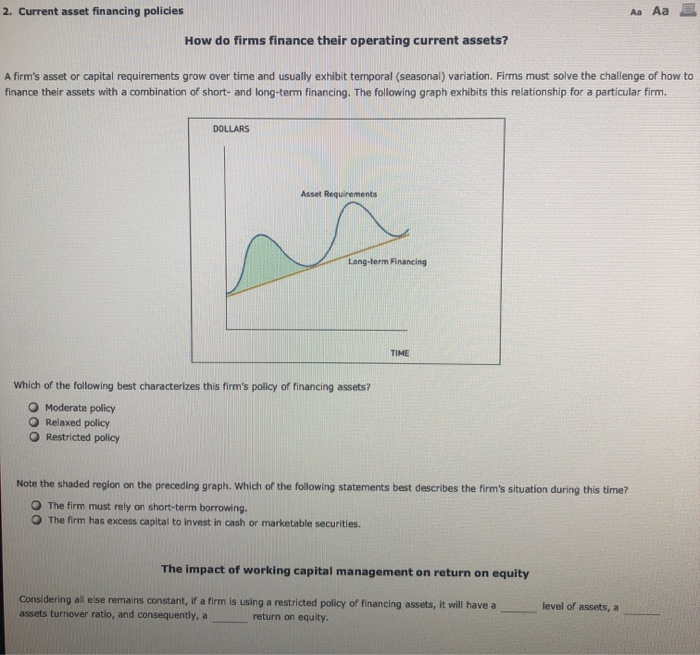

2. Current asset financing policies Aa Aa How do firms finance their operating current assets? A firm's asset or capital requirements grow over time and usually exhibit temporal (seasonal) variation. Firms must solve the challenge of how to finance their assets with a combination of short- and long-term financing. The following graph exhibits this relationship for a particular firm. DOLLARS Asset Requirements Long-term Financing Which of the following best characterizes this firm's policy of financing assets? Moderate policy Relaxed policy Restricted policy Note the shaded region on the preceding graph. Which of the following statements best describes the firm's situation during this time? O The firm must rely on short-term borrowing. The firm has excess capital to invest in cash or marketable securities. The impact of working capital management on return on equity Considering all else remains constant, if a firm is using a restricted policy of financing assets, it will have a assets turnover ratio, and consequently, a return on equity. level of assets, a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts