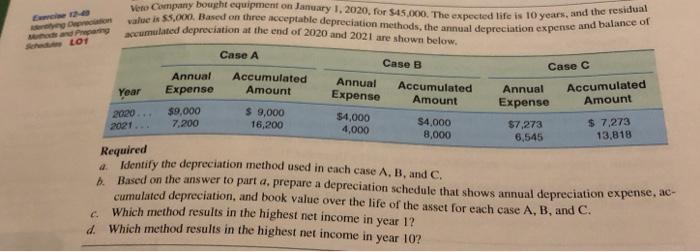

Question: bought equipment on January 1, 2020, for $45,000. The expected life is 10 years. y Veto Company Exercise 12-49 sying Depreciation value is $5,000. Based

bought equipment on January 1, 2020, for $45,000. The expected life is 10 years. y Veto Company Exercise 12-49 sying Depreciation value is $5,000. Based on three acceptable depreciation methods, the annual depreciation expense a end of 2020 and 2021 are shown below. and the residual accumulated depreciation at the n expense and balance of Sched Lo Case A Case B Case C Annual Accumulated Annual Accumulated Annual Am Year Expense Amount 2020... $9,000 2021.7,200 Expense Amount Amount $ 7,273 13,818 Expense $ 9,000 16,200 $4,000 $4,000 8,000 4,000 $7,273 6,545 Required Identify the depreciation method used in each case A, B, and C. b. Based on the answer to part a, prepare a depreciation schedule that shows annual depreciation expense, cumulated depreciation, and book value over the life of the asset for each case A, B, and C. Which method results in the highest net income in year 1? Which method results in the highest net income in year 10? C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts