Question: Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of

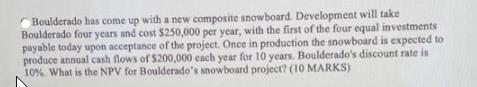

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%. What is the NPV for Boulderado's snowboard project? (10 MARKS)

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV of Boulderados snowboard project we need to discount the futu... View full answer

Get step-by-step solutions from verified subject matter experts