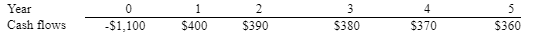

Question: Bowman Technology Systems (BTS) is considering a project that has the following cash flow and financial data. BTS's weighted average cost of capital = 11%

Bowman Technology Systems (BTS) is considering a project that has the following cash flow and financial data.

- BTS's weighted average cost of capital = 11%

- BTS anticipates that it can earn 2.5% on funds that it places with its broker

- BTS's income tax rate = 25%

- BTS determined that its CAPM return for its common stockholders' equity = 15%

- Before investing in this proposed project, BTS's balance sheet reported the following:

Total assets = $5,000

Total liabilities = $1,500

Common equity = $3,500

[a] Net present value

[b] Internal rate of return

[c] Modified internal rate of return

[d] Payback period

Year Cash flows 0 -$1,100 1 $400 2 $390 3 $380 4 $370 S $360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts