Question: BP has three potential sites where it can build a drilling rig. Due to its past experience, the CEO has instructed his management team to

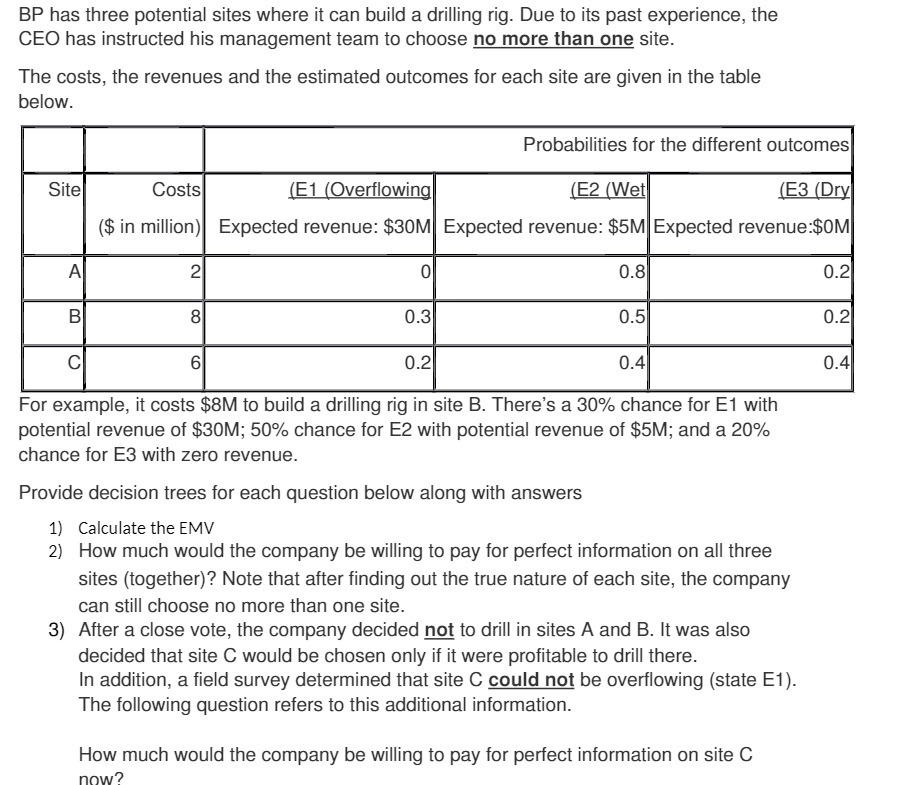

BP has three potential sites where it can build a drilling rig. Due to its past experience, the CEO has instructed his management team to choose no more than one site. The costs, the revenues and the estimated outcomes for each site are given in the table - Probabilities for the different outcomes ($ in million) Expected revenue: $30M Expected revenue: $5M Expected revenue:$t)M below. For example, it costs $8M to build a drilling rig in site B. There's a 36% chance for E1 with potential revenue of $30M; 50% chance for E2 with potential revenue of $5M; and a 20% chance for E3 with zero revenue. Provide decision trees for each question below along with answers 1) Calculate the HM! 2} How much would the company be willing to pay for perfect information on all three sites (together)? Note that after finding out the true nature of each site, the company can still choose no more than one site. 3) After a close vote, the company decided n_ot to drill in sites A and B. It was also decided that site C would be chosen only if it were profitable to drill there. ln addition, a field survey determined that site C could not be overowing (state E1). The following question refers to this additional information. How much would the company be willing to pay for perfect information on site C now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts