Question: Bradley Enterprises is considering two financial plans for next year. Management expects: EBIT = $ 5 0 , 0 0 0 Total assets = $

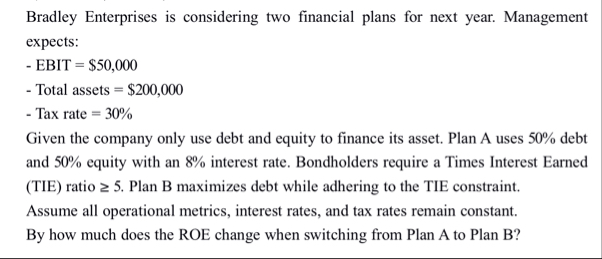

Bradley Enterprises is considering two financial plans for next year. Management expects:

EBIT$

Total assets $

Tax rate

Given the company only use debt and equity to finance its asset. Plan A uses debt and equity with an interest rate. Bondholders require a Times Interest Earned TIE ratio Plan B maximizes debt while adhering to the TIE constraint.

Assume all operational metrics, interest rates, and tax rates remain constant. By how much does the ROE change when switching from Plan A to Plan B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock