Question: Bramble makes and delivers delicious meals, either ordered directly off its menu or customized to its customers' specifications ( e . g . , meatless

Bramble makes and delivers delicious meals, either ordered directly off its menu or customized to its customers' specifications eg meatless or with jalapeos The company sells its meals to individual households as well as businesses and organizations throughout the metro area.

In determining its financial situation at the end of April, Bramble's accountant considered the jobs in process at the beginning of the month, along with costs and work done on jobs throughout April, and tallied costs to date on jobs that were not yet finished at the end of April, as follows.

At March Job # was the only job in inventory, and it was not yet finished. At that point, it had direct material costs of $ and had used direct labor hours.

During April, Bramble requisitioned the followed direct materials costs for these jobs: $ for Job # $ for Job # and $ for Job #

During April, Bramble used the following direct labor hours for these jobs: hours for Job # hours for Job # and hours for Job #

During April, the following MOH costs were recognized: depreciation on plant assets $ utility costs for the plant yet to be paid $ and salary for plant supervisor $ $ had been paid; $ was accrued

By the end of April, Job # had been completed and sold on credit Job # was completed but not yet sold, and Job # had not yet been completed.

Bramble's direct labor cost is $ hour. It allocates MOH on the basis of direct labor hours. At the beginning of the year, the company expected total MOH costs to be $ and direct labor hours to be Bramble sets its selling price at of its product

Current Attempt in Progress

Bramble makes and delivers delicious meals, either ordered directly off its menu or customized to its customers' specifications eg meatless or with jalapeos The company sells its meals to individual households as well as businesses and organizations throughout the metro area.

In determining its financial situation at the end of April, Bramble's accountant considered the jobs in process at the beginning of the month, along with costs and work done on jobs throughout April, and tallied costs to date on jobs that were not yet finished at the end of April, as follows.

At March Job # was the only job in inventory, and it was not yet finished. At that point, it had direct material costs of $ and had used direct labor hours.

During April, Bramble requisitioned the followed direct materials costs for these jobs: $ for Job # $ for Job # and $ for Job #

During April, Bramble used the following direct labor hours for these jobs: hours for Job # hours for Job # and hours for Job #

During April, the following MOH costs were recognized: depreciation on plant assets $ utility costs for the plant yet to be paid $ and salary for plant supervisor $ $ had been paid; $ was accrued

By the end of April, Job # had been completed and sold on credit Job # was completed but not yet sold, and Job # had not yet been completed.

Bramble's direct labor cost is $ hour. It allocates MOH on the basis of direct labor hours. At the beginning of the year, the company expected total MOH costs to be $ and direct labor hours to be Bramble sets its selling price at of its product costs.

a

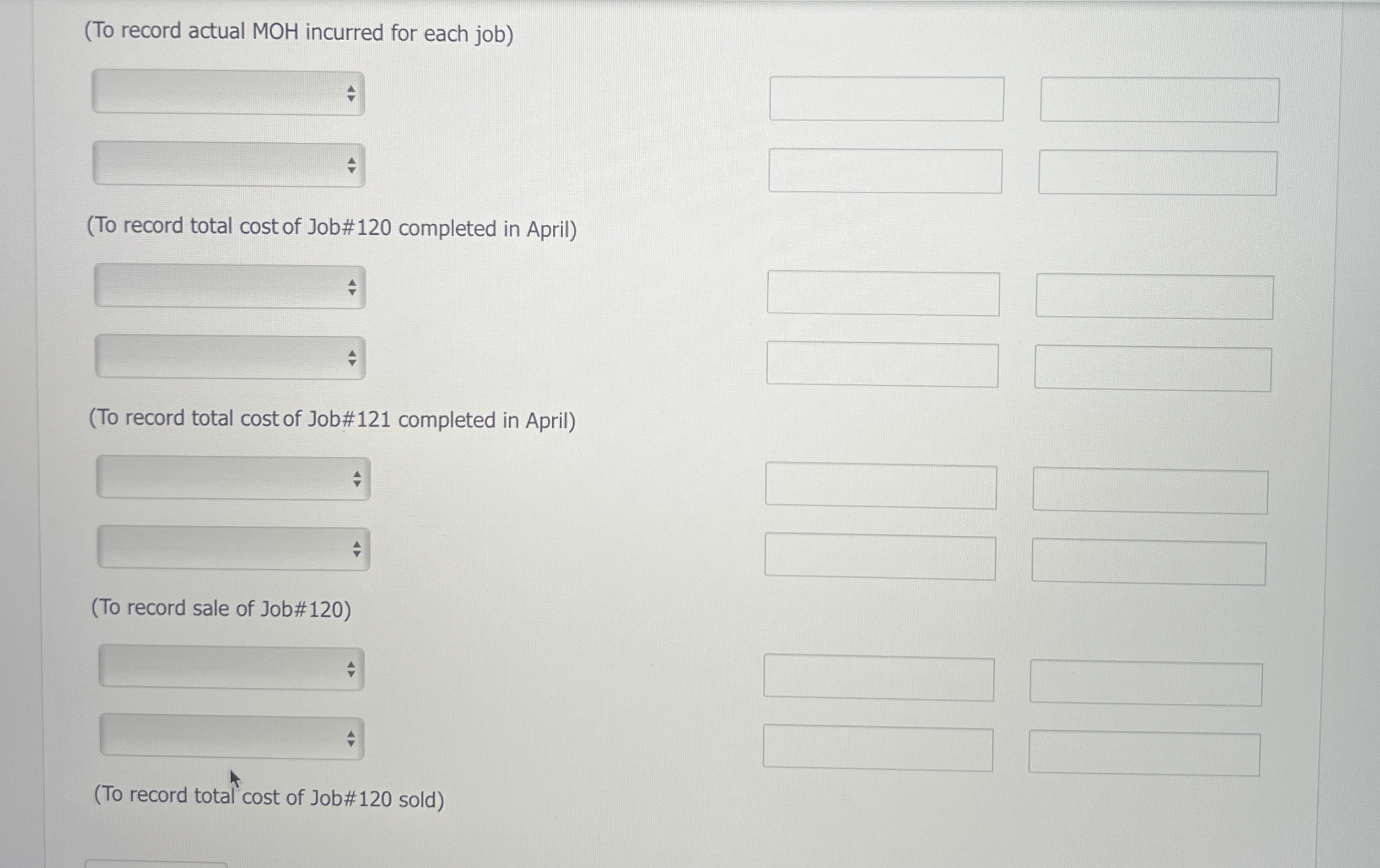

Record the journal entries to capture the above April transactions. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to decimal places, eg

Account Titles and Explanation

Debit

Credit

To record DM costs incurred for each job

To record DM costs incurred for each job recognizing the hourly

To record DM costs incurred for each job recognizing the hourly rate

To record applied MOH for ea

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock