Question: Brandon's Enterprises has purchased a new machine tool which will allow the company to improve the efficiency of its operations. On an annual basis, the

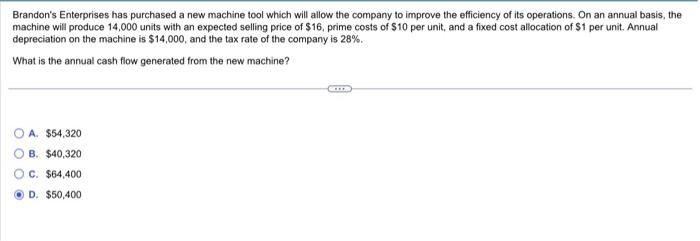

Brandon's Enterprises has purchased a new machine tool which will allow the company to improve the efficiency of its operations. On an annual basis, the machine will produce 14,000 units with an expected selling price of $16, prime costs of $10 per unit, and a fixed cost allocation of $1 per unit. Annual depreciation on the machine is $14,000, and the tax fate of the company is 28%. What is the annual cash flow generated from the new machine? A. $54,320 B. $40,320 C. $64,400 D. $50,400 Brandon's Enterprises has purchased a new machine tool which will allow the company to improve the efficiency of its operations. On an annual basis, the machine will produce 14,000 units with an expected selling price of $16, prime costs of $10 per unit, and a fixed cost allocation of $1 per unit. Annual depreciation on the machine is $14,000, and the tax fate of the company is 28%. What is the annual cash flow generated from the new machine? A. $54,320 B. $40,320 C. $64,400 D. $50,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts