Question: Bread Box, Inc. finances its operations using $1.50 of debt for every $2 of common stock. The pre- tax cost of debt is 7.5

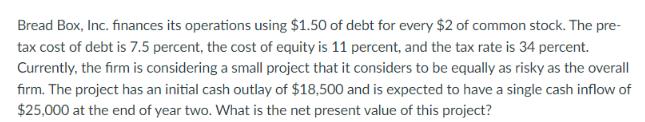

Bread Box, Inc. finances its operations using $1.50 of debt for every $2 of common stock. The pre- tax cost of debt is 7.5 percent, the cost of equity is 11 percent, and the tax rate is 34 percent. Currently, the firm is considering a small project that it considers to be equally as risky as the overall firm. The project has an initial cash outlay of $18,500 and is expected to have a single cash inflow of $25,000 at the end of year two. What is the net present value of this project?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV of the project we need to discount the cash flows at the appr... View full answer

Get step-by-step solutions from verified subject matter experts