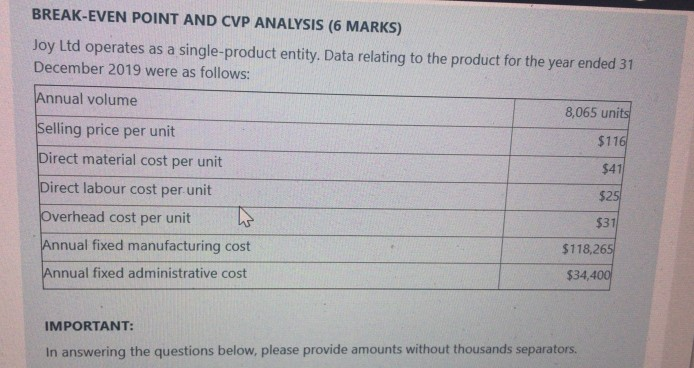

Question: BREAK-EVEN POINT AND CVP ANALYSIS (6 MARKS) Joy Ltd operates as a single-product entity. Data relating to the product for the year ended 31 December

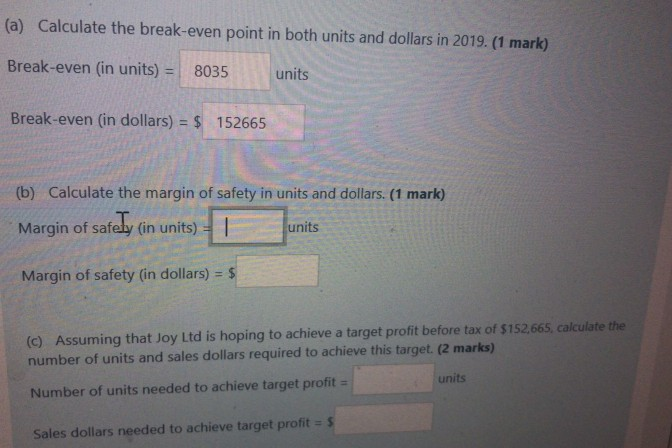

BREAK-EVEN POINT AND CVP ANALYSIS (6 MARKS) Joy Ltd operates as a single-product entity. Data relating to the product for the year ended 31 December 2019 were as follows: Annual volume 8,065 units Selling price per unit $116 Direct material cost per unit $41 Direct labour cost per unit $25 Overhead cost per unit th $31 Annual fixed manufacturing cost $118,265 Annual fixed administrative cost $34,400 IMPORTANT: In answering the questions below, please provide amounts without thousands separators. (a) Calculate the break-even point in both units and dollars in 2019. (1 mark) Break-even (in units) = 8035 units Break-even (in dollars) = $ 152665 (b) Calculate the margin of safety in units and dollars. (1 mark) Margin of safely (in units) units Margin of safety (in dollars) = $ (c) Assuming that Joy Ltd is hoping to achieve a target profit before tax of $152,665, calculate the number of units and sales dollars required to achieve this target. (2 marks) units Number of units needed to achieve target profit = Sales dollars needed to achieve target profit = 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts