Question: Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is avallable for each employee: For the current

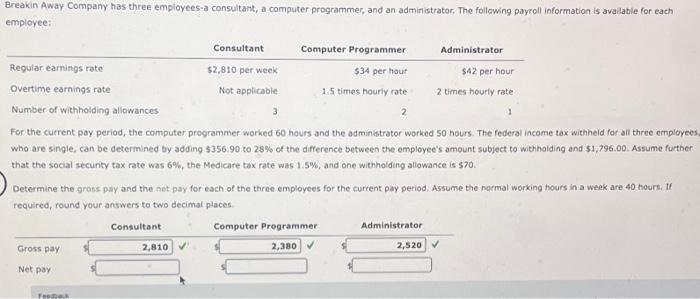

Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is avallable for each employee: For the current poy period, the computer programmer worked 60 hours and the adminstrator worked 50 hours. The federal income tax withheld for an three employee who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withhalding and 51.796 .00 . Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding aliowance is 570 . Determine the gross pay and the net pay. for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts