Question: Breau is a separate question, that question solution is simply to be used so you know the format/ how to answer this question. Please read

Breau is a separate question, that question solution is simply to be used so you know the format/ how to answer this question. Please read carefully. There are no tax credits. it is just calculate NITP/Taxable income. The deductions are restricted farm loss, net capital loss, non capital loss

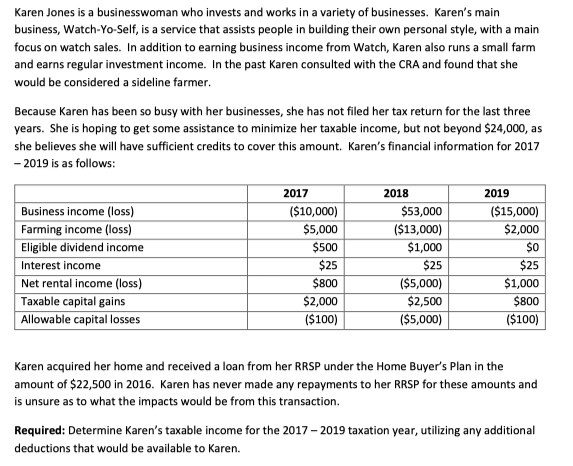

Karen Jones is a businesswoman who invests and works in a variety of businesses. Karen's main business, Watch-Yo-Self, is a service that assists people in building their own personal style, with a main focus on watch sales. In addition to earning business income from Watch, Karen also runs a small farm and earns regular investment income. In the past Karen consulted with the CRA and found that she would be considered a sideline farmer. Because Karen has been so busy with her businesses, she has not filed her tax return for the last three years. She is hoping to get some assistance to minimize her taxable income, but not beyond $24,000, as she believes she will have sufficient credits to cover this amount. Karen's financial information for 2017 -2019 is as follows: Karen acquired her home and received a loan from her RRSP under the Home Buyer's Plan in the amount of $22,500 in 2016 . Karen has never made any repayments to her RRSP for these amounts and is unsure as to what the impacts would be from this transaction. Required: Determine Karen's taxable income for the 2017 - 2019 taxation year, utilizing any additional deductions that would be available to Karen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts