Question: Brief analyse. Need answer! Answer Questions 5-7 based on the information below. Use the space provided to write-in your answer. A U.S.-based MNC has a

Brief analyse. Need answer!

Brief analyse. Need answer!

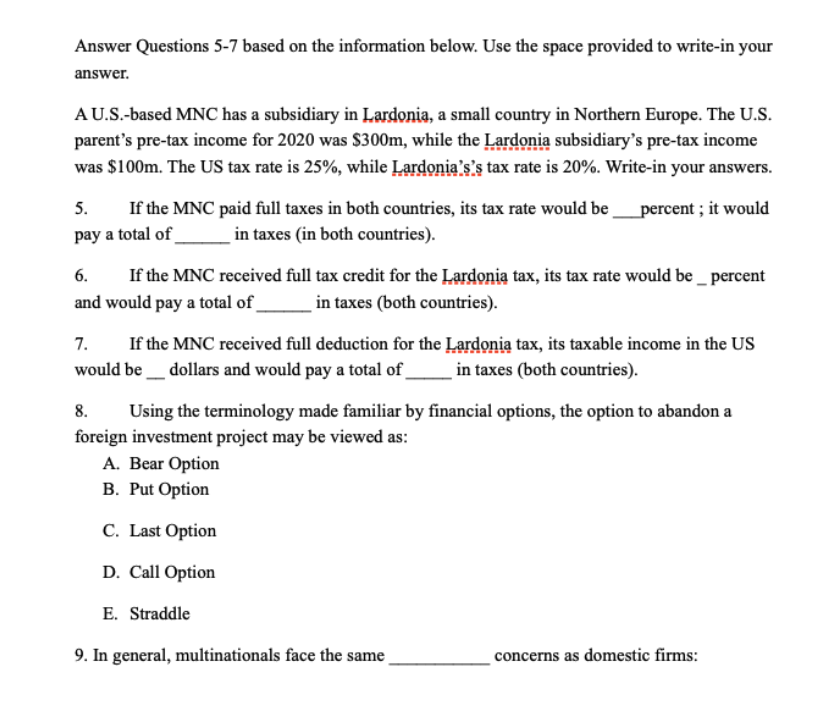

Answer Questions 5-7 based on the information below. Use the space provided to write-in your answer. A U.S.-based MNC has a subsidiary in Lardonia, a small country in Northern Europe. The U.S. parent's pre-tax income for 2020 was $300m, while the Lardonia subsidiary's pre-tax income was $100m. The US tax rate is 25%, while Lardoniaa's's tax rate is 20%. Write-in your answers. 5. If the MNC paid full taxes in both countries, its tax rate would be percent ; it would pay a total of in taxes (in both countries). 6. If the MNC received full tax credit for the Lardonia tax, its tax rate would be _percent and would pay a total of in taxes (both countries). 7. If the MNC received full deduction for the Lardonia tax, its taxable income in the US would be dollars and would pay a total of in taxes (both countries). 8. Using the terminology made familiar by financial options, the option to abandon a foreign investment project may be viewed as: A. Bear Option B. Put Option C. Last Option D. Call Option E. Straddle 9. In general, multinationals face the same concerns as domestic firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts