Question: Brief Exercise 1 6 - 5 ( Algo ) Temporary difference; income tax payable given [ LO 1 6 - 3 ] In 2 0

Brief Exercise Algo Temporary difference; income tax payable given LO

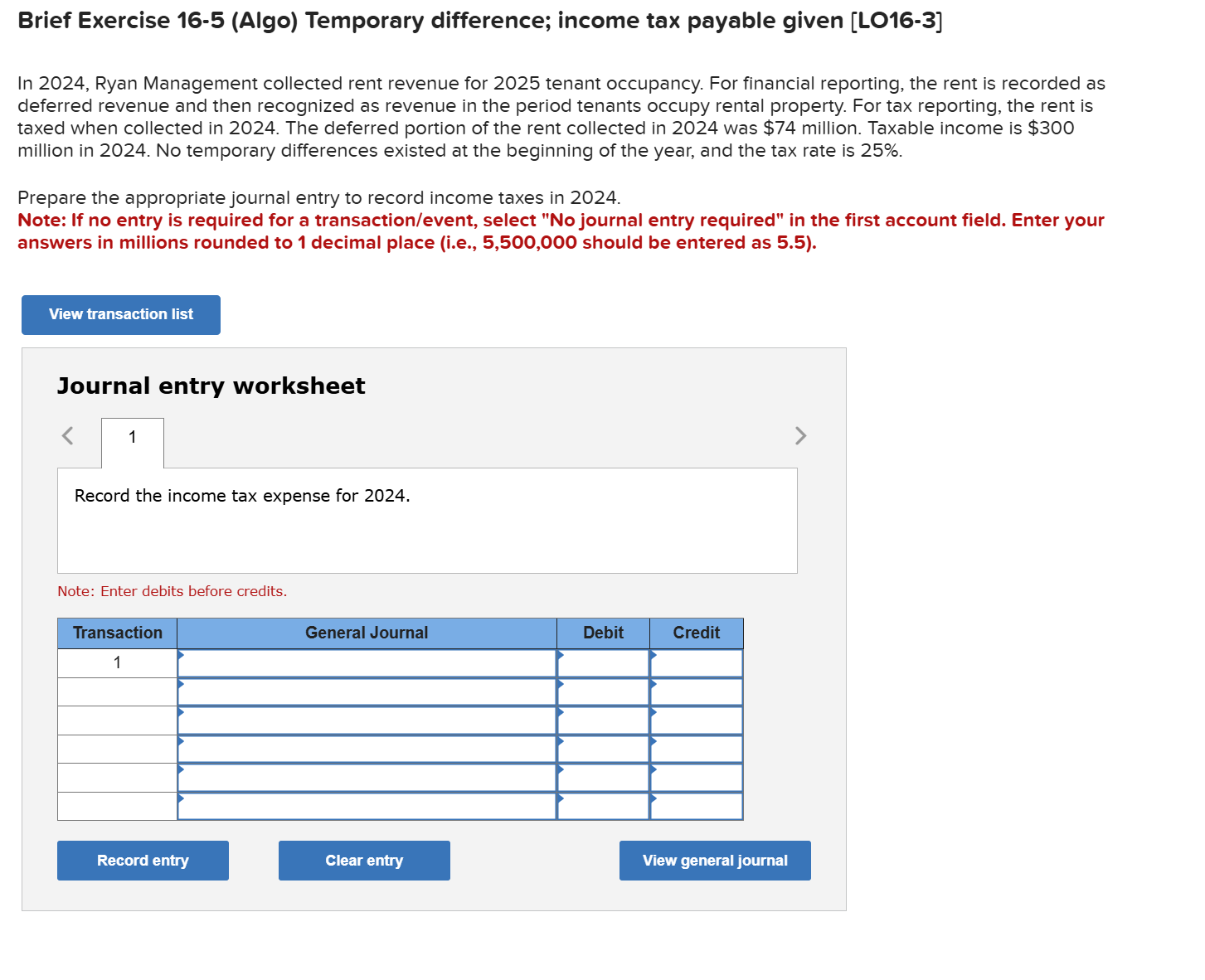

In Ryan Management collected rent revenue for tenant occupancy. For financial reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy rental property. For tax reporting, the rent is taxed when collected in The deferred portion of the rent collected in was $ million. Taxable income is $ million in No temporary differences existed at the beginning of the year, and the tax rate is

Prepare the appropriate journal entry to record income taxes in

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answers in millions rounded to decimal place ie should be entered as

Journal entry worksheet

Record the income tax expense for

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock