Question: Brief Exercise 10-04 Shamrock Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $900,000 on March

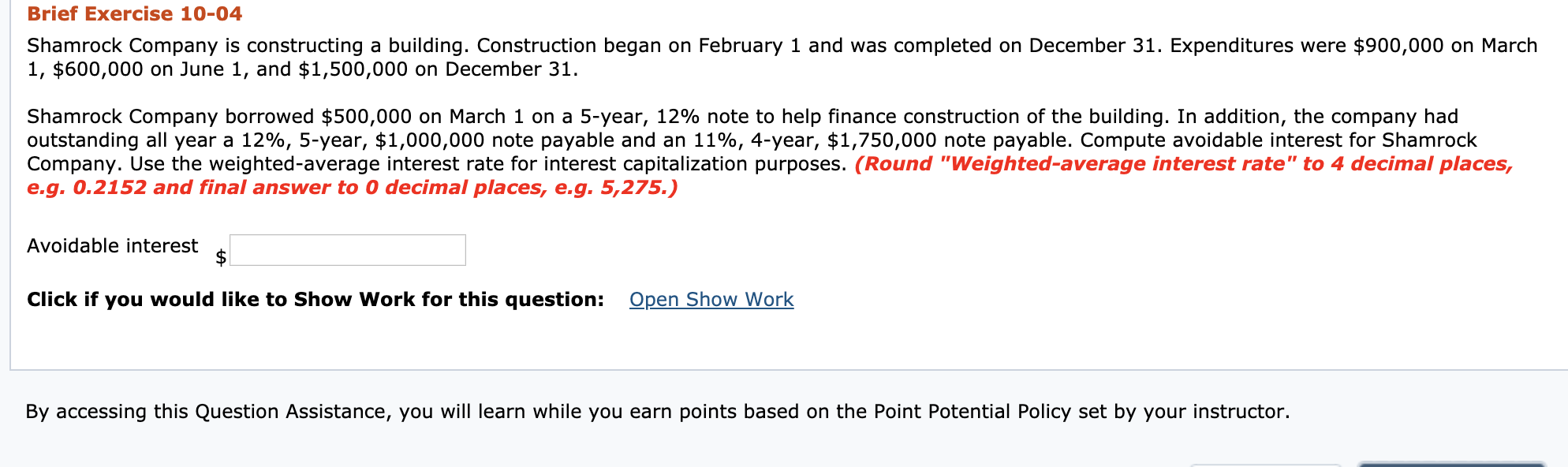

Brief Exercise 10-04 Shamrock Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $900,000 on March 1, $600,000 on June 1, and $1,500,000 on December 31. Shamrock Company borrowed $500,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5-year, $1,000,000 note payable and an 11%, 4-year, $1,750,000 note payable. Compute avoidable interest for Shamrock Company. Use the weighted average interest rate for interest capitalization purposes. (Round "Weighted-average interest rate" to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts