Question: Brief Exercise 10-15 Your answer is partially correct. Try again. Suppose the Canadian National Railway Company's (CN) total assets in a recent year were $24,000

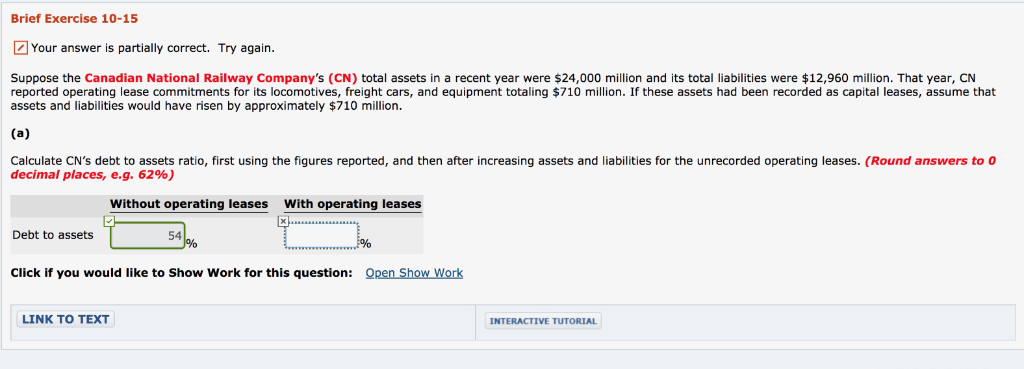

Brief Exercise 10-15 Your answer is partially correct. Try again. Suppose the Canadian National Railway Company's (CN) total assets in a recent year were $24,000 million and its total liabilities were $12,960 million. That year, CN reported operating lease commitments for its locomotives, freight cars, and equipment totaling $710 million. If these assets had been recorded as capital leases, assume that assets and liabilities would have risen by approximately $710 million. Calculate CN's debt to assets ratio, first using the figures reported, and then after increasing assets and liabilities for the unrecorded operating leases. (Round answers to 0 decimal places, e.g. 6296) Without operating leases With operating leases Debt to assets 54 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Brief Exercise 10-15 Your answer is partially correct. Try again. Suppose the Canadian National Railway Company's (CN) total assets in a recent year were $24,000 million and its total liabilities were $12,960 million. That year, CN reported operating lease commitments for its locomotives, freight cars, and equipment totaling $710 million. If these assets had been recorded as capital leases, assume that assets and liabilities would have risen by approximately $710 million. Calculate CN's debt to assets ratio, first using the figures reported, and then after increasing assets and liabilities for the unrecorded operating leases. (Round answers to 0 decimal places, e.g. 6296) Without operating leases With operating leases Debt to assets 54 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts