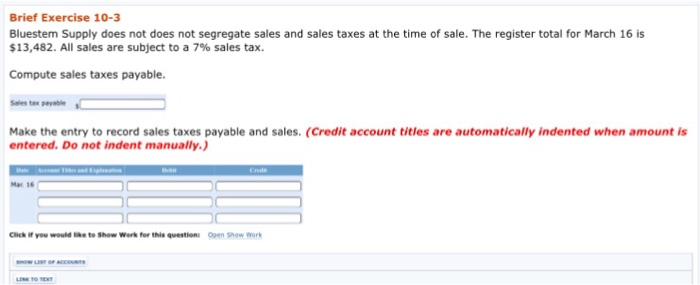

Question: Brief Exercise 10-3 Bluestem Supply does not does not segregate sales and sales taxes at the time of sale. The register total for March 16

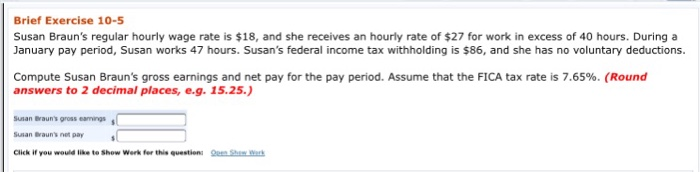

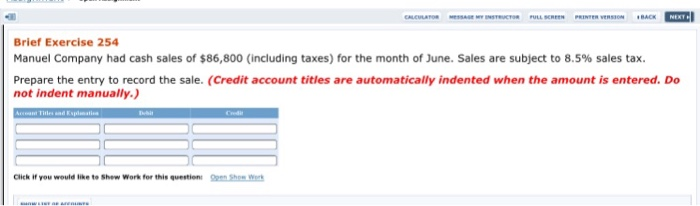

Brief Exercise 10-3 Bluestem Supply does not does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $13,482. All sales are subject to a 7% sales tax. Compute sales taxes payable Sales tex payable Make the entry to record sales taxes payable and sales. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Ma 16 Click if you would le to Show Werk for this questioni Ooen Show wrk Brief Exercise 10-5 Susan Braun's regular hourly wage rate is $18, and she receives an hourly rate of $27 for work in excess of 40 hours. During a January pay period, Susan works 47 hours. Susan's federal income tax withholding is $86, and she has no voluntary deductions. Compute Susan Braun's gross earnings and net pay for the pay period. Assume that the FICA tax rate is 7.65%. (Round answers to 2 decimal places, e.g. 15.25.) usan Brauns gross eaings Susan Braun's net pay Click if you would like to Show Werk fer this questions m Sh BACK Brief Exercise 254 Manuel Company had cash sales of $86,800 (including taxes) for the month of June. Sales are subject to 8.5% sales tax. Prepare the entry to record the sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Click if you would like te Shew Work for this question On Shem Werk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts