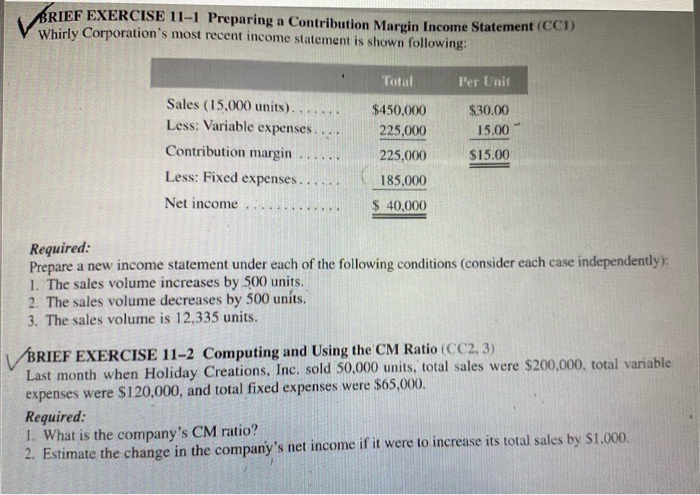

Question: BRIEF EXERCISE 11-1 Preparing a Contribution Margin Income Statement (CCI) Whirly Corporation's most recent income statement is shown following: Total T'er Unit $450,000 225,000 $30.00

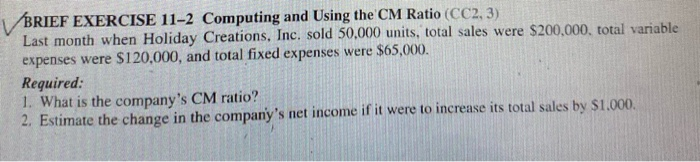

BRIEF EXERCISE 11-1 Preparing a Contribution Margin Income Statement (CCI) Whirly Corporation's most recent income statement is shown following: Total T'er Unit $450,000 225,000 $30.00 15.00 Sales (15,000 units). Less: Variable expenses. Contribution margin Less: Fixed expenses. Net income $15.00 - . 225,000 185,000 $ 40,000 Required: Prepare a new income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by 500 units. 2. The sales volume decreases by 500 units. 3. The sales volume is 12,335 units. BRIEF EXERCISE 11-2 Computing and Using the CM Ratio (CC2, 3) Last month when Holiday Creations, Inc. sold 50,000 units, total sales were $200,000, total variable expenses were $120,000, and total fixed expenses were $65,000. Required: 1. What is the company's CM ratio? 2. Estimate the change in the company's net income if it were to increase its total sales by S1.000. BRIEF EXERCISE 11-2 Computing and Using the CM Ratio (CC2, 3) Last month when Holiday Creations, Inc. sold 50,000 units, total sales were $200,000, total variable expenses were $120,000, and total fixed expenses were $65,000. Required: 1. What is the company's CM ratio? 2. Estimate the change in the company's net income if it were to increase its total sales by $1.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts